The regulatory component of construction costs is verging on between five and six figures for each new home built, but it’s not rising as fast as it previously was, or as quickly as building materials are.

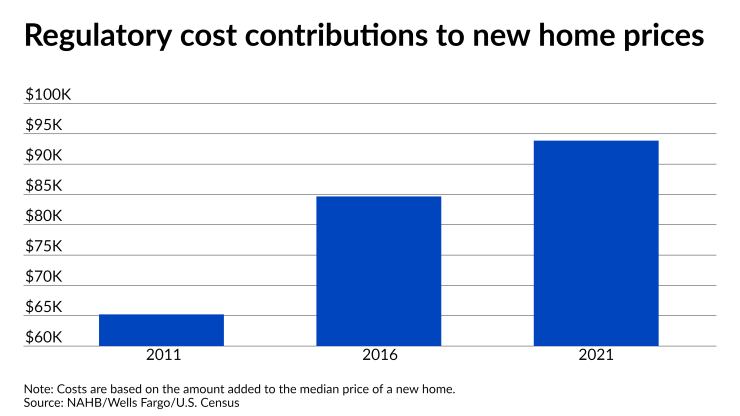

Regulation has added $93,870 to the median price of a new home so far in 2021, up nearly 11% from $84,671 in 2016, according to a study released Friday by the National Association of Home Builders. In comparison, the previous five-year period saw a 30% jump in regulatory expenses. And the most recent regulatory increase is also dwarfed by escalating material prices. In the past year alone, the price of

The significant amount that regulatory costs add to building points to one of the reasons why a Biden administration that’s aiming to create more affordable housing in a market with

Building codes account for the largest portion of the regulatory expenses at $24,144, followed by fees paid to purchase the lot at $12,184, and the costs of compliance related to things like studies or fees at $11,791. Also in the five-figure range are restrictions on land that’s left unbuilt due to ownership by the government or other factors at $10,854 and costs associated with extraordinary architectural design standards during construction at $10,794.

Other costs are as follows: development standards that go beyond the ordinary such as setbacks, $8,992; cost of applying for zoning approval, $6,483; and compliance with Occupational Safety and Health Administration and other labor-related rules during construction, $4,477.

It’s worth noting that while the price tag for regulation is hefty, it’s remarkably consistent. Regulatory costs account for roughly 27% of the NAHB’s estimated median home price of $346,757 and that percentage is roughly the same as it was when the regulatory costs in 2016 are compared to the Census Bureau’s figure for the median home price at the end of that year. At the end of 2011, regulatory costs represented about 29% of the median home price.

The findings in the study released Friday were based on a survey of land developer costs conducted in March, another poll done the same month for the NAHB/Wells Fargo Housing Market Index, and data from the U.S. Census Bureau.