The shift in mortgage rates has outpaced regulation as the housing market's main driver.

"We believe lenders are more currently focused on growing their business and are not as focused on hiring attorneys or compliance officers to sort through regulatory changes," said Brandon Dobell and Josh Lamers, equity researchers at William Blair, in an April 3 report on lender tech provider Ellie Mae.

Debt issuers also increasingly view the effect of rates on mortgage volumes as more of a key driver than regulation.

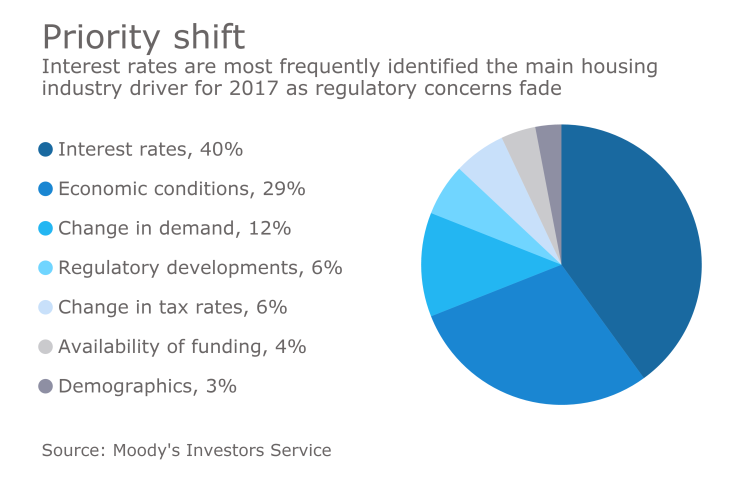

Forty percent of those surveyed from industries exposed to the housing market chose interest rates as the key focal point for residential real estate in the coming year, followed by economic indicators at 29% and change in demand at 12%. Only 6% think regulatory developments that dominated the housing agenda for years are the key concern now, according to the Moody's Investors Service survey released at the company's housing conference in New York last month.

As the shift in rates and the economy drives a forecast increase in purchases, overall volume decline, and interest in processing cost

Despite the overall decline in volumes, nonbanks that are key customers for Ellie Mae and some other vendors are expected to benefit from more market share. However,

Existing post-crisis regulation, while less of a priority, will still likely deter banks from lending to borrowers beyond those in their core customer bases, at least in the coming year.

A risk to that forecast is that "a more conducive regulatory environment could embolden larger banks to get more aggressive on pricing (and marketing spending) but given how 2017 has progressed, we view a rollback in mortgage regulations as being quite far off," according to William Blair.

Another risk to current forecasts is that lenders across the board could experience larger-than-expected volume drops because immigrants are a key part of purchase and housing market demographics at a time when tighter immigration controls are expected.

"Household formation should be about 1.2 million annually in upcoming years, though that would be dependent on the U.S. welcoming 1 million of net immigrants," Moody's noted in its report.

Only 3% of respondents to Moody's survey identified demographics as the main housing industry driver for 2017. That percentage rose slightly to 8% when respondents were asked to identify what the key driver of demand over the next three years will be.