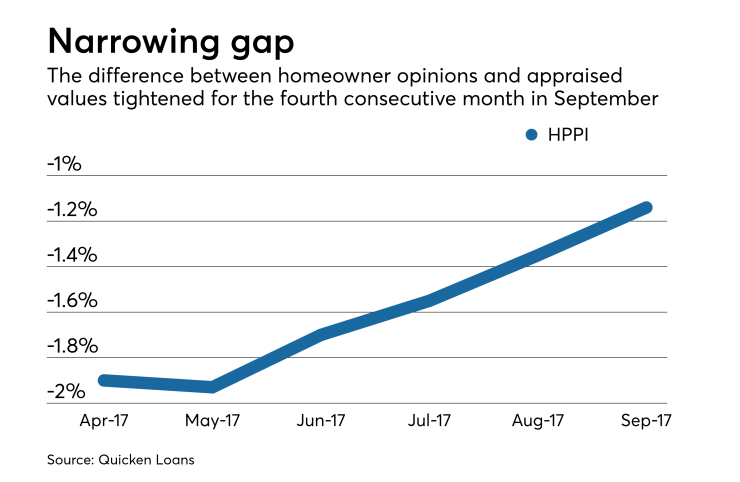

The gap between what consumers think a home is worth and its appraised value narrowed in September because of rising prices due to the continued inventory shortage, Quicken Loans said.

On average, a homeowner thought his or her home was worth 1.14% above its appraised value, compared with

September was the fourth consecutive month the gap between perception and actual valuations narrowed.

Appraised values increased 0.44% nationwide compared with August and 3.38% when compared with September 2016.

"Home values are highly impacted by the balance of buyer's interest and the volume of available homes. Currently this is highly tilted, with a lack of home inventory — leading to rising values," Bill Banfield, Quicken's executive vice president of capital markets, said in a press release.

"One of the most impactful things that could be done to achieve stability is an increase in new-home building. If move-up buyers move on to new construction, it will open up starter homes for first-time buyers."

Homeowners in Philadelphia had the largest perception gap among the major cities cited by Quicken, at 2.89%, followed by Baltimore at 2.68%, Cleveland at 2.24% and Chicago at 2.15%.

On the other hand, homeowners in Dallas underestimated the appraised value of their home by an average of 2.87%; in Denver, the underestimate was 2.52%. In Seattle it was 2.12, while for the Bay Area cities of San Jose and San Francisco, it was 1.73% and 1.63%, respectively.