Want unlimited access to top ideas and insights?

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending April 12 found that total volume fell 3.5% as the refinance index decreased 8%

Falling interest rates through much of the first quarter culminated in

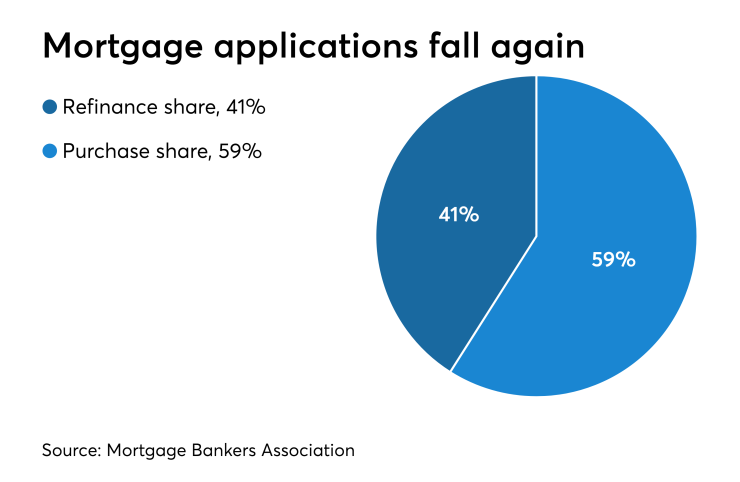

The refinance share of mortgage activity decreased to 41.5% of total applications from 44.1% the previous week.

"Mortgage applications decreased over the week, driven by a decline in refinances. With mortgage rates up for the second week in a row, it's no surprise that refinancings slid 8% and average loan sizes dropped back closer to normal levels," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

"Purchase activity remained strong and increased slightly, reaching its highest level since April 2010. The spring buying season continues to be robust, with activity more than 7% higher than a year ago and up year-over-year for the ninth straight week."

The seasonally adjusted purchase index increased 1% from one week earlier, while the unadjusted purchase index increased 2% compared with the previous week.

Adjustable-rate loan activity decreased to 6.6% from 7.6% of total applications, while the share of Federal Housing Administration-insured loans decreased to 9.4% from 9.6% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 11.6% from 11.1% and the U.S. Department of Agriculture/Rural Development share remained unchanged from 0.6% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased 4 basis points to 4.44%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $484,350), the average contract rate increased 5 basis points to 4.33%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 1 basis point to 4.43%. For 15-year fixed-rate mortgages, the average increased 1 basis point to 3.84%. The average contract interest rate for 5/1 ARMs increased to 3.88% from 3.78%.