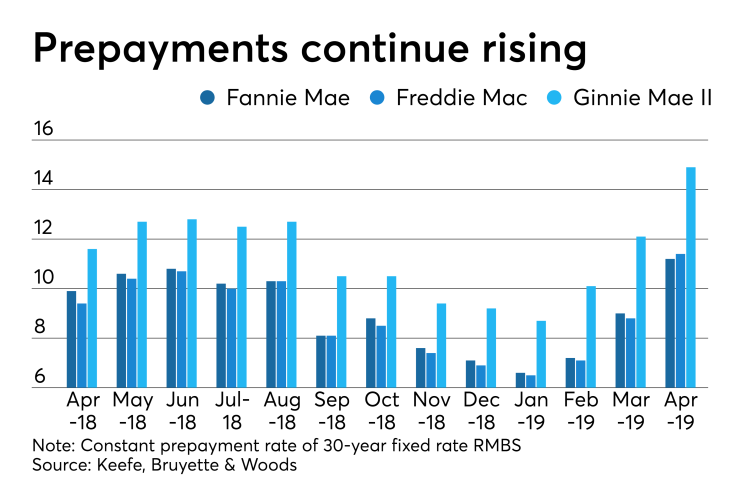

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

Prepayment speeds for 30-year fixed-rate mortgages in agency securities rose 25% in April from March. But the increase was not just driven by lower interest rates in February and March. April also had one more business day than the prior month and normal seasonality as home sales and purchases rose with the start of spring, said KBW analysts Bose George, Eric Hagen and Thomas McJoynt-Griffith.

Fannie Mae MBS with a 4% coupon had a 13.1 constant prepayment rate, up from a 9.7 CPR in March; most of that increase came from newer loans, KBW pointed out.

April came with an 11.2 CPR for all Fannie Mae 30-year FRM securities, compared with a 9.9 CPR year-over-year and a 9 CPR in March. Freddie Mac 30-year FRM securities had an 11.4 CPR, up from a 9.4 CPR one year ago and 8.8 CPR last month; over the same time frame, the CPR for

Previously, KBW said $550 million of mortgages with coupons of 4.5% or higher originated during 2018 would

"Fannie 4% and 4.5% MBS, which were the primary cohorts most vulnerable to an increase following the February and March rate rally, each paid down at 13.1 and 14.3 CPR, respectively, which is below their six-year average of 15.9 and 19.2 CPR," KBW added. The prepayments involving 2018 securities with 4% coupons increased 69% from March.

The average for the

Observers tied the May drop to investor worries over trade with China. On the morning of May 13, the same day the KBW report came out, those worries drove the Dow Jones Industrial Average down over 500 points. In turn the 10-year Treasury yield, which was up to 2.6% on April 17, fell to 2.4% by 11 a.m.

"While the overall level of current coupon prepays remains low by historical measures, the increase still had an impact on mortgage REITs," which invest in RMBS, the KBW analysts said. "Nevertheless, we expect the increase in speeds, and impact on mortgage REITs, to be relatively contained assuming rates stay rangebound."

The increase in prepayment expectations for the second quarter because of the first-quarter interest rate rally should pressure the earnings at mortgage REITs, a group that includes New Residential, Annaly, AGNC, Capstead, Dynex, Invesco, Two Harbors, PennyMac and Redwood Trust, KBW said.