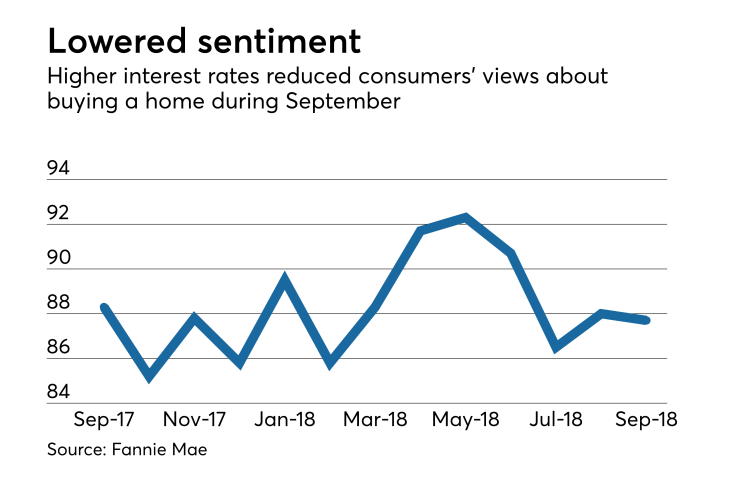

Rising interest rates, both current and the prospect for future increases, took a toll on consumers' outlook on the housing market during September, according to Fannie Mae.

The Fannie Mae Home Purchase Sentiment Index fell 0.3 points to 87.7, partially

There was a four percentage point increase from August and a nine percentage point rise from last September in the net percentage of consumers who believe mortgage rates will increase in the next 12 months, to 56%.

Meanwhile, respondents whose household income was significantly higher than it was 12 months ago fell three percentage points from August. The net percentage of those who were confident about keeping their job was still high at 79%, but this was down one percentage point from August.

There was also a one percentage point increase among those that felt home prices will rise in the next 12 months.

"Perceptions of high home prices and expectations for rising mortgage rates continue to weigh on potential homebuyers," Doug Duncan, senior vice president and chief economist at Fannie Mae, said in a press release.

"In September, the average 30-year fixed mortgage rate increased for the second consecutive month to 4.63%, its highest level since May 2011. In addition, the Federal Open Market Committee members' interest rate projections at the September meeting continued to point to four additional rate increases between now and the end of 2019."

The good news was that the net percentage of those believing September was a good time to buy a home was up five percentage points. The net percentage of those who said September was a good time to sell was unchanged.

"Still, downside risk to housing is limited by