High home prices and expected interest rate hikes should lead to continued growth in multifamily mortgage origination volume in 2019, according to Freddie Mac.

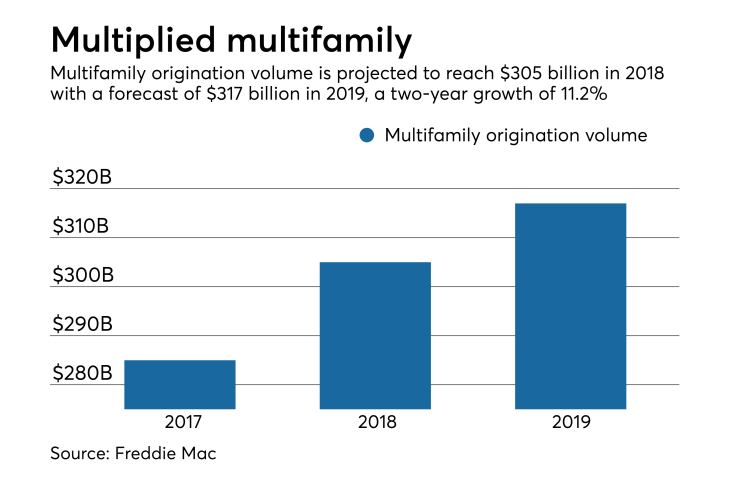

The outlook for the nascent year's multifamily origination volume is forecasted at $317 billion, a 3.9% increase over 2018's projection of $305 billion. If the projection holds, 2018 would end up with a 7% year-over-year growth from 2017's volume of $285 billion. The volume has risen every year since 2009.

"Even with continued growth in supply, we expect vacancy rates to remain below historical averages in 2019, and we see rent growth reaching 4%," Steve Guggenmos, Freddie Mac multifamily research and modeling vice president, said in a press release. "Along with demographic trends and the shift in consumer preferences toward urban areas, we examine the comparatively high cost of homeownership by market and that is another important factor that will continue to drive healthy performance in the multifamily market."

While the rate should slow in 2019, the cost of home buying is

Over the last three years, the cumulative cost of homeownership increased 23.8% on the national level, while rents cumulatively rose 14.1%. Of the 39 major metro areas measured, only Philadelphia had a lower cost to own in the same time frame.

The disparity in cost growth helps paint the picture of the overall tumbling