Increased equity levels are resulting in higher appraisals that are closer to owners' view of home prices now than they have been since March 2015, according to Quicken Loans.

Appraisals were on average just 0.5% lower than homeowners' original estimates in December 2017, Quicken's latest Home Price Perception Index shows. In November 2017, appraised values were 0.67% lower. The previous year, appraised values were more than 1% lower. In March 2015,

The overall reduced gap between homeowners' estimates and lower appraisals in the U.S. reflects a market where, in some local markets, appraisals are even higher than what consumers anticipated.

"The housing markets that are rising quickly, like those in the West, are having appraisal values increasing above owner estimates because owners don't realize just how quickly those markets are advancing," said Bill Banfield, executive vice president of capital markets, in a press release.

"With several years of growth, owners may have more equity than they realize," Banfield said.

Overall, the HPPI still shows the average appraisal even in the West is 0.24% lower than the homeowner's perception of value.

But the difference is more pronounced in other areas.

Appraisers' perception of value is on average 0.53% lower than the homeowners' in the South. It's 0.68% lower in the Northeast, and it's 0.71% lower in the Midwest.

Home values based solely on appraisal data are increasing in all regions except the Northeast, where they dropped 0.21% from the previous month.

During the same period, values were up 0.55% in the West, 0.39% in the South and 0.03% in the Midwest, according to Quicken's Home Value Index.

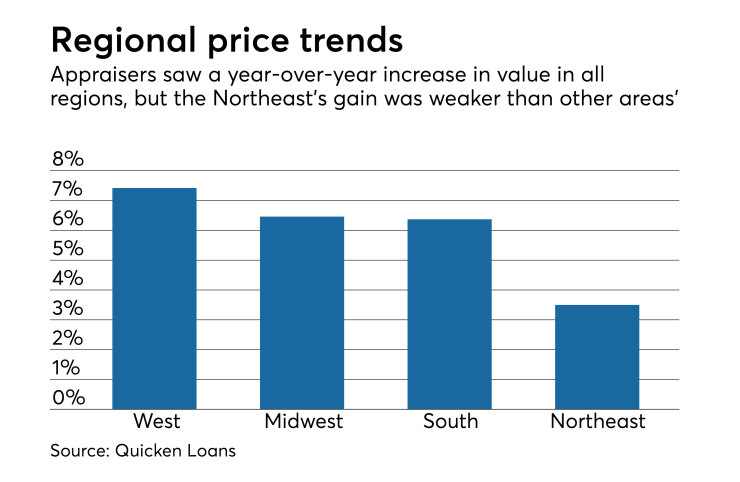

Year-to-year, values are higher in all regions, as follows: 7.42% in the West, 6.46% in the Midwest, 6.37% in the South and 3.5% in the Northeast.