Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

Ocwen Financial, for example, will benefit from "the growth of its servicing portfolio and

Also Provident Funding's fair value increases in its mortgage servicing rights last year "only partially offset the company's loss on extinguishment of debt and other nonrecurring losses," Moody's analysts Gene Berman, Warren Kornfeld, Brian Harris, Ana Arsov and Ashlee Reilly said in the report.

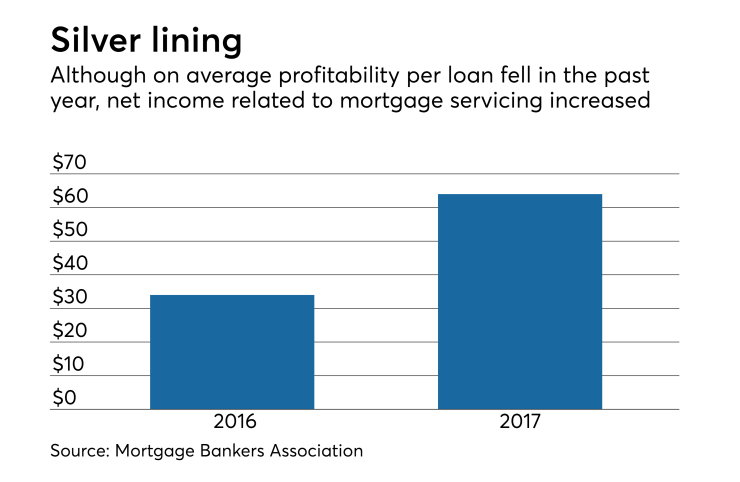

Despite such challenges, the profitability for the servicing side of the consolidating mortgage business is relatively favorable compared to origination profits.

While overall, the average profit per loan at independent mortgage banks and mortgage subsidiaries of chartered banks declined to $711 from $1,346 in a past year, a servicing-related component of that profit rose.

Net servicing operational income, when combined with mortgage servicing rights amortization and net gains and losses on MSR losses in the past year almost doubled, climbing to $64 per loan from $34 per loan the previous year.

"Originators' profitability continues to decline" due to diminishing volume that "will drive originators to compete on price to defend market share," while "servicers' profitability was flat to modestly higher in 2017 from 2016," the analysts noted in the report.

These market conditions have been favorable for real estate investment trusts, which "continue to demonstrate solid and improving profitability," according to Moody's.

Due to these factors, while there has already been "some fresh consolidation in the mortgage industry over the past six months," there "will likely be further consolidation in the industry in 2018," the analysts said.

Eventually, the shakeout will benefit surviving companies in the business, they said.

Consolidation will lead "to a gradual improvement in margins and profitability that will help stabilize the sector," according to Moody's.