Ocwen Financial is receiving a lump-sum payment of $280 million from New Residential under the latest restructuring of the mortgage servicing rights sale.

That payment is due in five business days, a Securities and Exchange Commission filing Ocwen made on Jan. 18 said.

The transaction,

However, the transfer process remains stalled as the necessary third-party consents have yet to be obtained.

As of Jan. 1, that portfolio was at $86.8 billion; $14.8 billion of MSRs already had been transferred to New Residential.

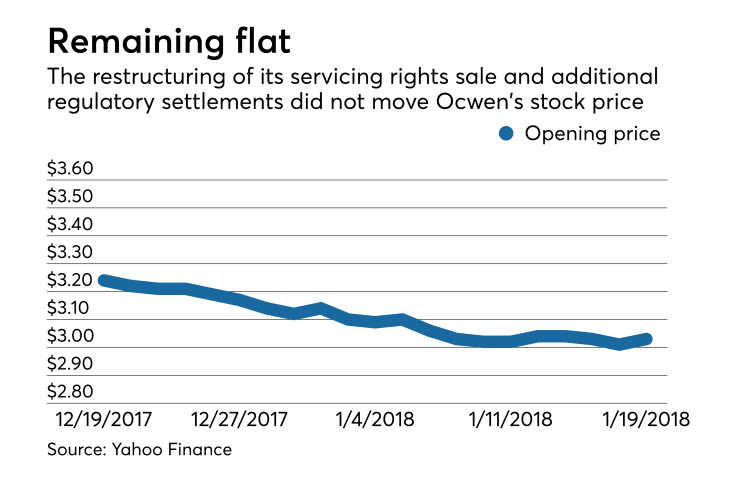

The filing, made before the market opened, had no impact on Ocwen's stock price, remaining slightly above $3 per share as it has since the start of 2018.

This new agreement "will accelerate the implementation of certain parts of our arrangement in order to achieve the intent of the July agreements sooner," the filing said.

The July agreement anticipated that New Residential would pay a lump sum for each time MSRs were transferred. The payments were a proxy for the difference between the higher revenue Ocwen would have received servicing the loans under its previous arrangement with New Residential and the lower revenue it would get going forward.

With this change, "Ocwen will receive substantially identical compensation for servicing the related mortgage loans underlying the Subject MSRs that it would receive if the Subject MSRs had been transferred to New Residential as named servicer and Ocwen subserviced such mortgage loans for New Residential as named servicer," the SEC said.

In addition, New Residential waived its rights to replace Ocwen as the servicer if there were any residential servicer rating agency downgrades.

In the same SEC filing, Ocwen said it

The agreement leaves three state regulators with cease and desist orders against the company — Connecticut, Maryland and Massachusetts — and two state attorneys general, Florida (which was the other state that spearheaded the April actions) and Massachusetts. The Florida Office of Financial Regulation is a co-plaintiff with the state AG.

The Consumer Financial Protection Bureau is also a plaintiff and in response, Ocwen