Home prices have not recovered enough to protect the states with high concentrations of home equity lines of credit whose rates are scheduled to reset in the next few years.

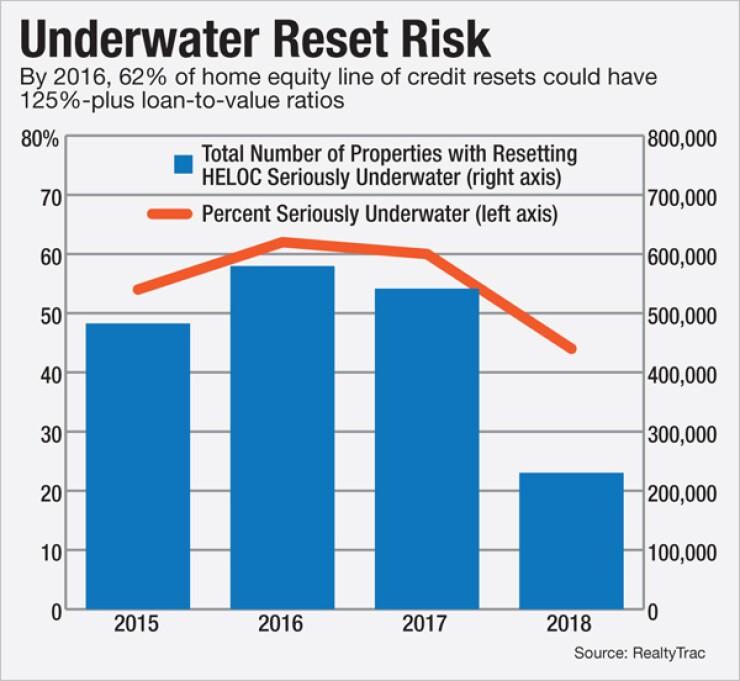

Forty percent of these HELOCs were seriously underwater in 2014, and this year more than half of these loans will have loan-to-value ratios of 125% or more, according to RealtyTrac. When homeowners owe more than their homes are worth, they are more likely to default, particularly if their monthly bill spikes, all other things being equal.

Last year, a wave of more than 700,000 resetting HELOCs came and went

"I was surprised at how serious a problem they appear to be," Daren Blomquist, vice president at RealtyTrac, said in an interview.

The percentage of underwater properties will most likely peak in 2016 at 62%, corresponding to a period 10 years after the peak of the U.S. housing bubble. The percentages thereafter are currently projected to drop to 59% in 2017 and 44% in 2018. For the report, RealtyTrac analyzed open HELOCs originated between 2005 and 2008 with the assumption that these loans will reset with fully amortizing monthly payments after a 10-year period of interest-only payments.

The underwater properties are mostly in areas where values haven't fully recovered: California, Florida, Illinois, Texas and New Jersey. Values in states like Florida have recovered somewhat, but those values may still be well below where they were in the peak housing bubble years, 2006 and 2007, Blomquist noted.

Reset risk may have been contained to date because at least some of the banks are out ahead of this problem and reaching out to homeowners, he said. A limited number

With the payment increase, some borrowers will decide that it is no longer worth holding on to pay more on a home that has not regained its equity, Blomquist said.

"This could be enough of a shock to some borrowers where they just walk away from the property altogether," said Blomquist. "If they could have already refinanced, they would have."