As mortgage rates remained mostly tepid throughout the summer, closed refinances had their first month of growth in August, according to Ellie Mae.

The refinance share of closed loans went up to 32%, trailing August 2017's share of 35%, but

"The rise in interest rates has slowed since June, and we are seeing the percentage of refinances increase month-over-month since May," Jonathan Corr, president and CEO of Ellie Mae, said in a press release. "This may reflect consumers taking an opportunity to refinance with the corresponding increase in equity."

Closing rates for all loans grew to the highest percentage of 2018 at 71.1%. That rate is down from 71.7% year-over-year, but up from July's 70.9%.

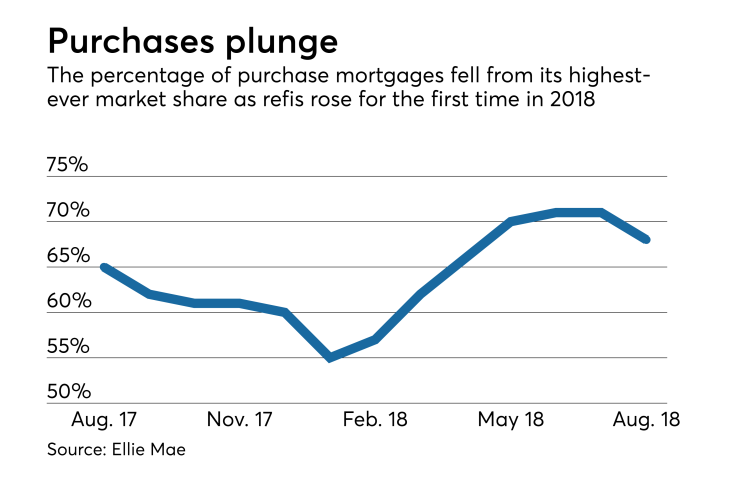

The share of closed purchase mortgages dropped to 68% in August after holding steady at 71% for two consecutive months — the highest purchase share recorded by Ellie Mae since it started tracking it in 2011 — according to the latest Origination Insight report.

A year ago, purchases made up 65% of closed loans in the market. Purchase share in 2017 peaked at 68% last June, a figure already met or surpassed four times this year.

The lowest purchase shares seen since the start of 2017 both took place in the seasonally weak month of January. Those shares were 55% in 2018 and dropped to 53% last year.

The adjustable-rate mortgage share, which tends to rise as mortgage interest rates do, stayed static at 6.6% for the second month in a row. ARMs represented 5.7% of all closed loans in August 2017.