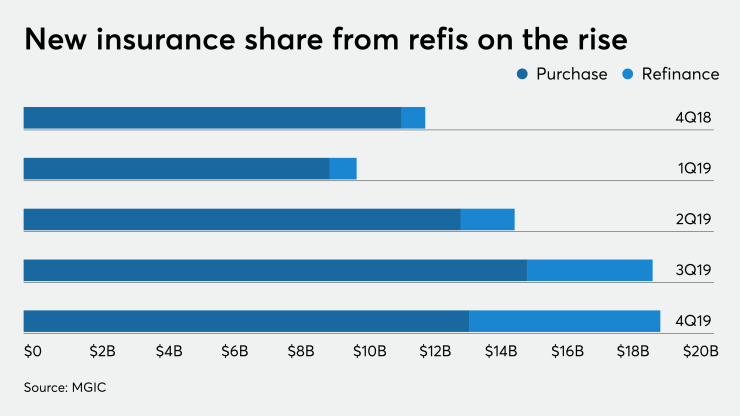

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

But that same factor cut into its persistency, the measure of how much insurance-in-force remains in effect on the same day versus the prior year.

MGIC reported net income of $177.1 million for the fourth quarter, compared with $176.9 million for the third quarter and $157.7 million

Its operating earnings per share of $0.49 beat B. Riley FBR's estimate of $0.83. "The beat, compared to our model, came from lower losses and expenses," analyst Randy Binner wrote in an alert.

New insurance written totaled $19.3 billion, with refinancings accounting for 30%. Binner only forecast $12.2 billion in NIW for the quarter.

This

"The credit performance for the new business written remains outstanding, the legacy book continued to decrease in size and contribute fewer delinquencies, and we maintained a low expense level," MGIC CEO Tim Mattke said in a press release. "In 2019 we repurchased $114 million of our common stock outstanding, established a quarterly common stock dividend midyear that distributed a total of $42 million, continued to use quota share and excess of loss reinsurance to reduce potential future earnings volatility from credit losses and enhance our returns, decreased our debt ratio, continued our positive credit ratings trajectory, and increased dividends from MGIC to our holding company to $280 million." Mattke was referring to the annual dividend.

In the quarter, MGIC's operating unit received permission from Wisconsin insurance regulators to pay a $70 million quarterly dividend and a special $320 million dividend to the holding company.

Insurance-in-force rose to $222.3 billion as of Dec. 31, up 2% from the end of the third quarter and 6% from the prior year. Mattke noted the IIF growth occurred even as persistency fell to 75.8% at the end of the fourth quarter from 78.6% in the third quarter and 81.7% as of Dec. 31, 2018. This metric landed well below Binner's expectations of 84%.

MGIC's delinquent loan inventory was 30,028 units, 12% of which was written in 2008 or earlier; these books of business were responsible for 60% of the 13,694 new notices of default.

The inventory increased for the second consecutive quarter. In the third quarter, there were 29,940 loans in the inventory and in the second quarter there were 29,795. For the fourth quarter of 2018, the inventory stood at 32,898 loans.

Still MGIC — which reported earnings before the other active private mortgage insurers — will again serve as bellwether for the other companies.

"Overall, we view this as a favorable result for MGIC and expect this trend to continue to the other PMIs, such as NMI Holdings and Radian," Binner wrote.

Recent headlines about housing finance reform and changes to the qualified mortgage patch are benign for the industry, he added.

"It is increasingly less likely that we will see meaningful GSE reform before the November election, despite the recent