Redwood Trust projected that its nonagency mortgage activity would recover in the second half of this year, as it released its second-quarter results.

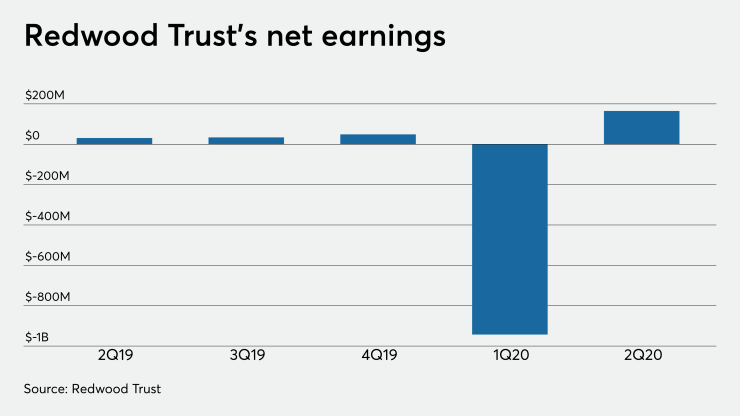

The real estate investment trust posted a turnaround in the second quarter, with net income of $165 million, compared with a net loss of $943 million in the first quarter and net earnings of $31 million for the

"We're extremely pleased with the progress we've made in response to the collapse of liquidity that the nongovernment mortgage sector experienced in March," CEO Chris Abate said on Redwood's conference call.

During the quarter, the Mill Valley, Calif.-based firm repositioned its secured debt structure by reducing total recourse debt to $1.8 billion at June 30 from $4.6 billion at March 31, and its marginable debt to $375 million from $3.5 billion.

Redwood Trust's non-qualified mortgage business was,

But the pendulum is starting to swing the other way.

"Based on our recent engagement with loan sellers and narrowing of the spread between agency and jumbo mortgage rates, we've begun to see a pickup in lock activity and expect this to grow meaningfully as we head into the fall," Abate said.

"Even with this narrowing, we continue to see substantial relative value in nonagency home loans, a sentiment shared by our loan buying partners, both current and prospective," he added.

Redwood's residential lending segment had net income of $33 million, versus a first-quarter loss of $199 million, while its business purpose lending — loans to single-family rental property owners and bridge loans — had net income of $46 million, compared with a net loss of $228 million.

Following a brief pause in residential lending activity, Redwood purchased $56 million during the second quarter. At June 30, it had $20 million in jumbo loans on its balance sheet and had identified $57 million of loans for purchase through forward sale agreements.

It also made $176 million in single-family rental loans and $58 million in bridge loans.