Redfin's acquisition of Bay Equity Home Loans boosts the real estate company's presence in the mortgage business at a time when purchases are expected to dominate the marketplace.

"Our long-term vision is to combine lending and brokerage services into new ways for people to move from one home to another," Redfin CEO Glenn Kelman said in a press release. "Buying Bay Equity not only gives us the scale to execute better on the first stage of this vision; it also gives us the latitude to start earlier on the second stage, which will let Redfin customers buy homes they couldn't have gotten through a stand-alone broker or lender."

Redfin will pay approximately $135 million, two-thirds in cash and one-third stock, for Bay Equity, a mortgage banker based in Corte Madera, Calif.

While Redfin is paying a premium for Bay Equity, at two times tangible book value, "particularly in what will be a down year for mortgage in 2022, the relatively strong purchase origination volume should slot in well, and allow Redfin to leverage its core brokerage, and its iBuying businesses, to drive synergies and continued purchase volume in what we expect to be a still strong year for the residential real estate market," Wedbush Securities analyst Ygal Arounian said in a research report.

However, because of the transaction, Redfin will eliminate 121 of the current 250 positions from its existing mortgage lending business.

Those employees, primarily working in sales support, capital markets and operations positions, will have the opportunity, if they choose, to find another role at Redfin.

"Many of these people are the pioneers who helped build Redfin Mortgage from scratch and we owe them a debt of gratitude," Adam Wiener, president of real estate operations, said in the press release. "Our transition team will deliver the white-glove service our employees deserve to make their transition to a new role at Redfin or a new company as seamless as possible."

The remaining Redfin Mortgage employees will move to Bay Equity.

Redfin Mortgage started business

However, "Redfin was struggling to grow its mortgage capacity throughout 2021 given the record year in the mortgage industry, first around improving its technology infrastructure to service more loans, and then hiring more mortgage originators and sales staff," Arounian noted. Buying Bay Equity moves Redfin closer to developing a full end-to-end residential real estate product offering, he added.

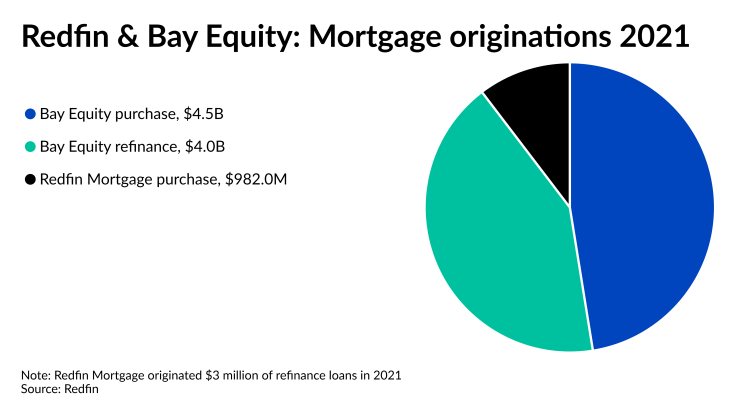

Bay Equity originated $8.5 billion in mortgage loans last year, $4.5 billion from purchases. It has 1,200 employees and is licensed in 48 states.

That dwarfs Redfin Mortgage, which did $985 million last year, nearly all of it in purchase loans; the company did just $3 million of refinancings. It is licensed in 24 states.

Bay Equity also offers a full product suite, whereas Redfin Mortgage only does conforming loans.

Purchase loans are expected to dominate the landscape this year, with industry economists