If you want to get high property value appreciation,

From April 2017 to April 2021, home prices grew by an average of $17,113 more in states that permit recreational cannabis sales over those where it’s prohibited or strictly only available for medicinal use, according to Clever Real Estate. While the marijuana industry has already boosted

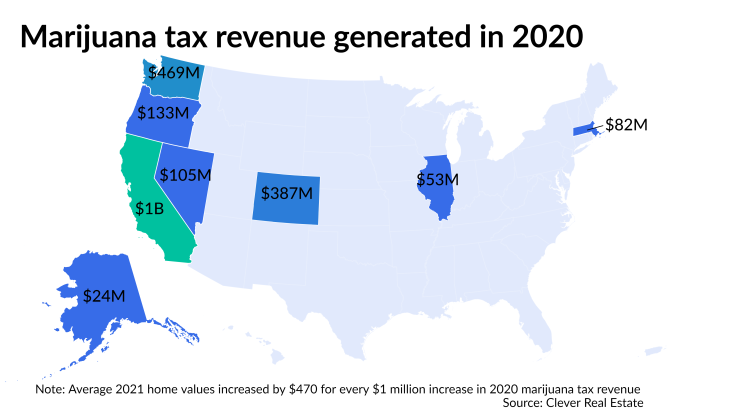

Eight states collected taxes on the sales of it in 2020, generating $2.3 billion in combined revenue. California led the eight with over $1 billion, followed by $469.2 million in Washington and $387.5 million in Colorado.

In 2021, housing values increased $470 for every $1 million in 2020’s pot tax revenue, Clever’s study found. They increase by an additional $519 for every new dispensary a city adds. This new revenue stream gets reinvested into infrastructure, education and public services. The improved quality of living raises demand for those markets and drives prices.

The returns on home price growth wouldn’t be diminished if recreational sales became legal in all states due to the direct impact on local economies, Clever Data Scientist Francesca Ortegren told NMN.

“Even now we see that more dispensaries is correlated with higher home values within states where sales are currently legal, so we’d expect that trend to continue,” she said.

As of July 2021, a total of 36 states and Washington, D.C. legalized recreational cannabis to some degree. Five states — Montana, New Mexico, New York, Virginia and Vermont — legalized recreational cannabis but haven’t begun sales. The study estimates that price growth would have been cumulatively 13.5% higher if sales were allowed in those states over the four-year time period. Housing values jumped $22,090 more in cities with recreational dispensaries, compared to those in cities where recreational marijuana is legal but dispensaries don’t yet exist.

“An interesting phenomenon we might encounter is county or city-level regulations prohibiting sales within legal states,” Ortegren said. “Prohibiting sales of recreational marijuana in a municipality would cause citizens to venture out to purchase marijuana and reduce the amount of cash flow in the ‘dry’ county. Even counties that don’t allow alcohol generate far less tax revenue than their ‘wet’ counterparts.”