The U.S. economy is likely to enter into a recession in the first quarter of 2023 due to a combination of high inflation, monetary policy tightening, and a slowing housing market, Fannie Mae's latest forecast predicts.

The government-sponsored enterprise's Chief Economist Doug Duncan first mentioned the likelihood of a recession in his

This new forecast reinforces Fannie Mae's July update expecting

Duncan predicts the Federal Open Market Committee will raise short-term rates another 75 basis points at its meeting later today.

At the same time, after a downturn in August, mortgage rates began climbing again,

"In our view, the recent interest rate surge is due to the market's recognition of two critical factors: that inflation is indeed not transitory, and that, to tame it, the Federal Reserve will need to be resolute, even at the risk of possible recession," said Duncan said in a press release. "Inflation's entrenchment — and the policy action likely required of the Fed — confirms the expectation in our forecast of a moderate recession beginning in the first quarter of 2023."

Taking the opposite position are the economists from the UCLA Anderson Forecast, who claim its data-driven analysis suggests that the U.S. is not currently in a recession and that the chance of a recession in the next 12 months is less than 50%.

But it does cite some downside risks, including a downturn in housing markets related to rising mortgage rates.

"There is tremendous uncertainty about what will happen over the course of the next 12 months and through the end of our forecast horizon," said UCLA Anderson Forecast Senior Economist Leo Feler in a press release. "While we have not forecast a recession at this time, the risks to the U.S. economy are asymmetric to the downside."

Arch MI's Housing and Mortgage Market Review declared home prices should not experience a sustained decline on a national basis over the next year, even with a strong chance the overall economy could enter a recession.

"Key factors bolstering our belief in a soft landing for national home prices are the still-tight inventory of homes for sale and the long-term fundamental shortage of homes," said Parker Ross, Arch Global Mortgage Group's senior vice president and chief economist. "Despite the slowdown in home sales activity, the market for existing homes has yet to recover to typical pre-pandemic inventory levels as the pace of new listings has slowed as well."

Previous Fed increases have had the desired effect on housing as home price growth has slowed starting in June, Duncan added.

"We expect the slowdown in housing to continue through 2023 as affordability constraints mount for potential homebuyers, and considering, too, that refinance activity has been significantly curtailed by the rise in mortgage rates," he continued.

While the First American potential home sales model increased on a month-to-month basis in August for the first time in nearly a year, economic uncertainty is an overhang on the market.

And it is difficult to quantify how much that is depressing housing activity, First American Chief Economist Mark Fleming said.

"Buying a home is the largest financial decision a person will likely make, and that is predicated on one's financial security and confidence in the economy," Fleming said in a press release. "The ongoing inflationary environment and risk of a recession with potential labor market consequences remain a concern, severely impacting consumer confidence."

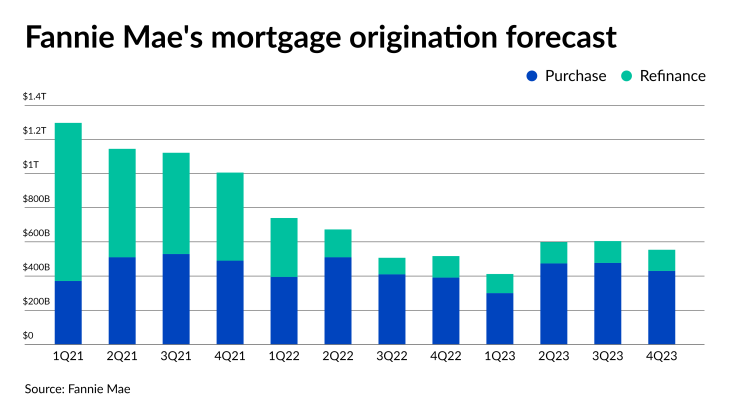

Fannie Mae increased its 2021 originations total to $4.57 trillion, approximately $101 billion higher than it previously determined, based on the latest Home Mortgage Disclosure Act data release.

However, its September forecast for 2022 was unchanged at $2.437 trillion. But it did cut its refinance expectations to $731 billion from $769 million. The latest purchase forecast is for $1.706 trillion, approximately $2 billion higher.

The 2023 outlook was cut to $2.17 trillion from $2.29 trillion, as Duncan now forecasts lower home sales reducing purchase volume and higher rates further curtailing refinancings. Fannie Mae now expects $1.68 trillion of purchase and $490 billion of refis next year, compared with just under $1.7 trillion and $592 billion respectively one month ago.

Earlier this week, the Mortgage Bankers Association updated its 2022 forecast to $2.324 trillion, a slight reduction from August's $2.344 trillion. That comes entirely from a reduction in its purchase outlook to $1.618 trillion from $1.638 trillion.

The MBA did not change its 2023 and 2024 forecasts.

Freddie Mac releases its economic forecasts on a quarterly basis, with the next one coming in the fourth quarter.