Quicken Loans is now able to perform an

"We are continually researching, building and

Through Amrock, a title and settlement services provider that is a sister company to Quicken (both are owned by Rock Holdings), there are three ways to complete a mortgage electronically: through an in-person hybrid e-closing; an in-person electronic notarization; or a

Borrowers refinancing into a conventional fixed-rate loan for a single-family home are eligible for an e-closing as long as they meet the other eligibility requirements; for example, a loan using a power of attorney is not eligible for an e-closing.

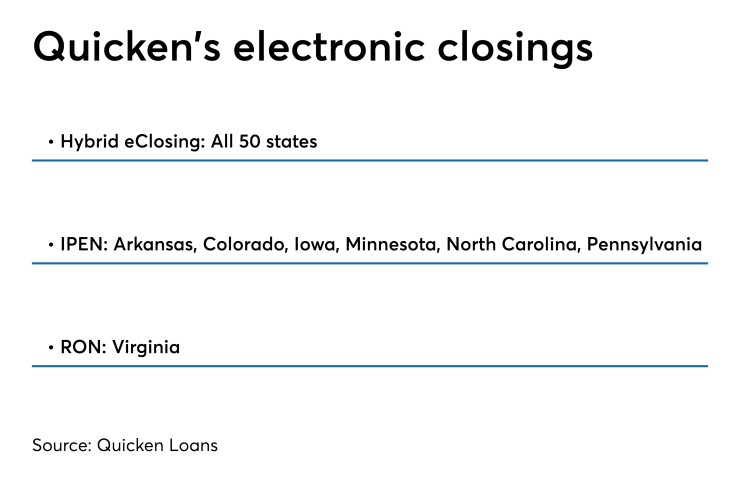

The hybrid e-closing is the only method available in all 50 states, according to Quicken; the IPEN e-closing is only available in Arkansas, Colorado, Minnesota,

Mortgage brokers, regional banks and credit unions that do business with Quicken's QLMS in 33 states and the District of Columbia, can use the hybrid e-closing process with their customers, as long as Amrock is chosen as the title provider.

Separately, Guaranteed Rate, in conjunction with

"Our vision at Guaranteed Rate is to deliver a simple, best-in-class homebuying experience for every generation," said Guaranteed Rate Chief Operating Officer Nikolaos Athanasiou in a press release. "We are thrilled to announce our enhancements to FlashClose, which puts even more power in the hands of homebuyers — wherever and however they want to close."