Want unlimited access to top ideas and insights?

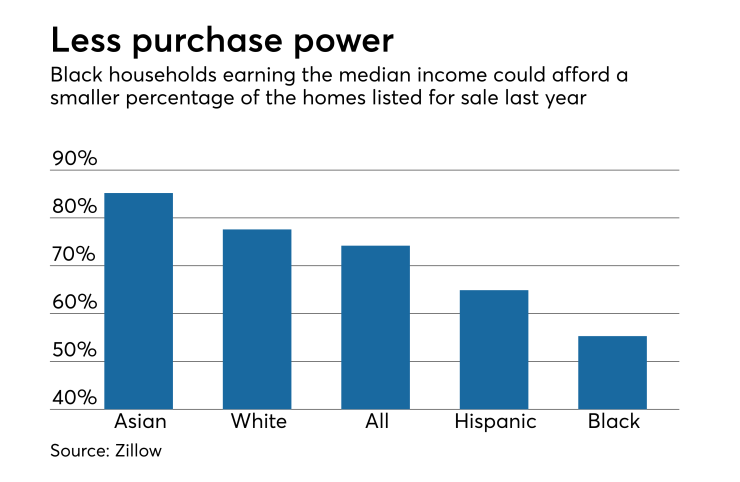

Black households have significantly less purchasing power when it comes to buying a home compared with other races, a Zillow study said.

A homebuyer that made the median income for a black household of $39,466 could only afford 55.3% of the homes listed for sale last year. The study used an affordability assumption of no more than 30% of the borrower's income going toward the monthly mortgage payment.

With rising mortgage interest rates and rising home prices due to the inventory shortage, affordability,

For all Americans, 74.2% of homes listed last year were affordable to a homebuyer making a median household income of $58,978.

The group with the most purchasing power was Asian homebuyers, with a median household income of $82,627, which meant they could afford 85.2% of the homes listed. White homebuyers, with a median household income of $64,647, could afford to purchase the 74.2% of the homes listed.

Hispanic homebuyers had a median household income of $47,990, which was enough to afford 64.9% of all homes listed in 2017.

Zillow released its research on April 11, the 50th anniversary of President Lyndon Johnson signing the Fair Housing Act.

Homeownership is seen as one way for American families to build household wealth. But while white homeowners had just 38.1% of their net worth tied to their primary residence, this was true for 64.7% of Hispanic homeowners and 55.6% of black homeowners, according to Federal Reserve Board data

The gap in the homeownership rate between whites and blacks, if anything, has widened slightly in the past century. In 1900, 48.1% of whites and 20.5% of blacks owned a home;

"The divide between black and white Americans has proven stubbornly persistent across the long arc of American history, visible in incomes, accumulated wealth and homeownership," said Zillow Senior Economist Aaron Terrazas in a press release.

"Greater wealth eases the path to homeownership, and the relationship becomes self-reinforcing: Homeowners have greater access to financial wealth that, in turn, makes it easier to become and remain homeowners. Distinct racial and ethnic gaps in homeownership exist nationwide, which could have long-lasting implications for future generations."