Purchase and refinance applications both

The MBA’s Market Composite Index — a measure of loan-application volume determined through a weekly survey of MBA members — increased 2.8% on a seasonally adjusted basis for the period ending August 6. The unadjusted index also showed a 3% uptick. The seasonally adjusted application numbers fell 11.5% below the mark posted the same week last year.

After declining to its lowest levels in over a year for two consecutive weeks, purchase volumes headed upward again, with the seasonally adjusted index rising 2%. The unadjusted index climbed 1% but was 18% lower on a year-over-year basis. An increase in government-backed mortgage applications, such as those guaranteed by the Federal Housing Administration, pushed the Purchase Index higher, according to Joel Kan, the MBA’s associate vice president of economic and industry forecasting.

“With low for-sale inventory keeping home-price appreciation in many markets at record highs, the jump in FHA purchase applications is potentially a sign that more first-time buyers are finding purchase options despite the high prices,” he said in a press statement.

After a one-week decrease, the Refinance Index also picked back up, climbing 3% while remaining 8% below the year-ago level. The total number of refinance applications for the week amounted to 68% of overall volume, a slightly higher share than the previous week’s 67.6%.

“Homeowners continue to respond to lower rates, with refinance activity climbing to the highest level since February 2021,” Kan added.

The share of adjustable-rate mortgage applications dropped two basis points week-over-week, coming in at 3.2%, down from 3.4% the prior week.

Average loan amounts see only slight changes

The mean mortgage size moved little from one week earlier. Refinance mortgages averaged $321,900 for the second consecutive week, while average purchase-loan size grew only 0.1%, up to $394,600 from $394,100. The overall average loan size for all mortgages inched down to $345,200 from $345,300 one week earlier,

Although

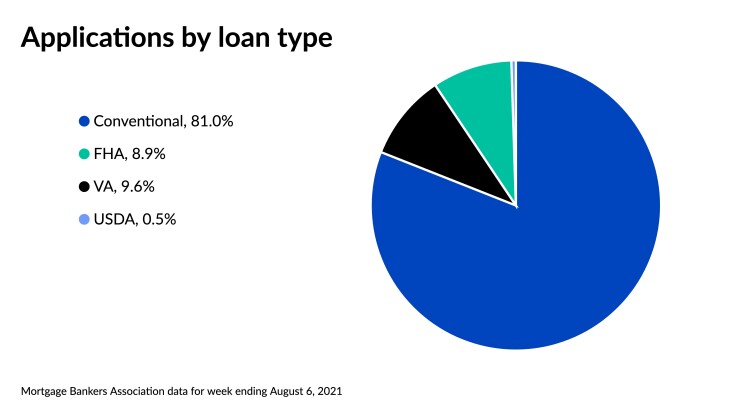

Despite the increase in the number of purchase applications taken through federally sponsored programs, the share of government-backed mortgages dropped slightly lower on a week-over-week basis. FHA-sponsored loans took an 8.9% share, compared to 9% the prior week. Veterans Administration-backed mortgages decreased to 9.6% of total volume, down from 9.9% a week earlier, and the share of applications supported by the U.S. Department of Agriculture remained unchanged at 0.5%.

30-year conforming rate creeps back up

Following the release of

- The average contract interest rate of 30-year fixed-rate mortgages with conforming loan balances of $548,250 or less climbed to 2.99%, up two basis points from 2.97% the previous week.

- The average contract interest rate of 30-year fixed-rate jumbo loans with balances greater than $548,250 also moved upward, coming in at 3.15%, compared to 3.12% the prior week.

- Average FHA-backed 30-year fixed-rate mortgages contract interest rates decreased to 3.06% from 3.08% one week earlier.

- After two straight weeks falling to record lows, the contract interest rate of 15-year fixed-rate mortgages inched up two basis points to 2.35% from 2.33% a week earlier.

- The 5/1 adjustable-rate average dropped over 40 basis points for the week, decreasing to 2.52% from 2.93%.