For the first time in three weeks, mortgage application volume increased, this time by 2.2%, as purchase activity was up in a holiday-shortened week, according to the Mortgage Bankers Association.

The MBA's Weekly Mortgage Applications Survey for the week ending July 3 found that the seasonally adjusted purchase index was up 5%

"The average purchase loan size increased to $365,700 — also another high — as borrowers contend with limited supply and higher home prices," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Refinance applications increased slightly, driven by a 2% rise in conventional refinances."

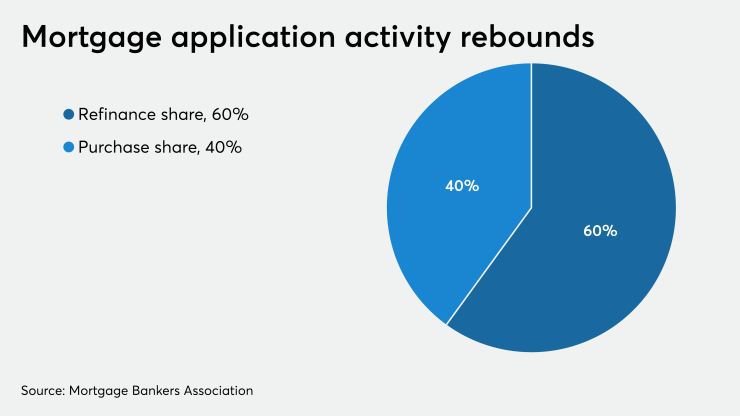

There was only a 0.4% increase in the refinance index on a week-to-week basis, although it was 111% higher than the same week one year ago. The share of refi applications submitted decreased to 60.1% of total applications from 61.2% the previous week.

It took a while, but borrowers finally reacted to the continued decline in mortgage rates, Kan noted.

"Mortgage rates declined to another record low as renewed fears of a coronavirus resurgence offset the impacts from a week of mostly positive economic data, such as June factory orders and payroll employment," Kan said. "The 30-year fixed rate slipped to 3.26% — down 53 basis points since late March. Borrowers acted in response to these lower rates, after accounting for the July 4th holiday."

Adjustable-rate mortgage activity increased to 3.4% from 3.2% of total applications, while the share of Federal Housing Administration-insured loan applications decreased to 10.9% from 11.7% the week prior.

The share of applications for Veterans Affairs-guaranteed loans decreased to 10.4% from 10.8% and the U.S. Department of Agriculture/Rural Development share increased to 0.7% from 0.6% the week prior.

Mortgage rates dropped for all product types, with the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased 3 basis points to 3.26%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate decreased 7 basis points to 3.52%.

But the largest week-to-week decline was in the average contract interest rate for 30-year fixed-rate mortgages backed by the FHA, down 12 basis points to 3.31%. For 15-year fixed-rate mortgages, the average decreased 4 basis points to 2.77%. The average contract interest rate for 5/1 ARMs decreased 6 basis points to 2.98%.