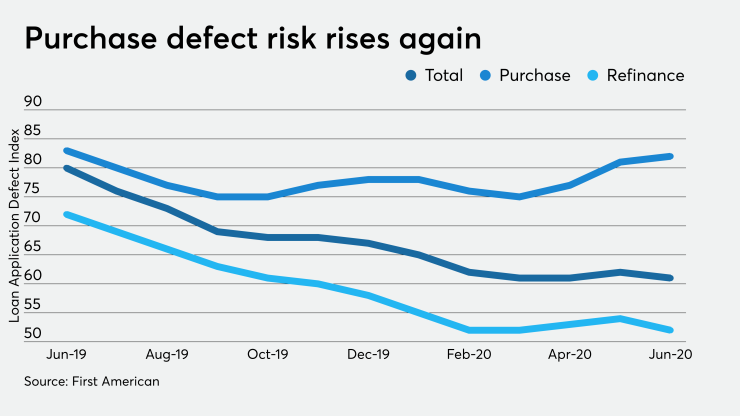

Even as mortgage loan application defect risk returned to record-low levels in June driven by the refinance boom, fraud risk for purchases is perking up, First American Financial said.

June's purchase mortgage loan application defect risk index is the highest in a year as the

"The result of increasing demand for homes driven by low mortgage rates against limited inventory of homes for sale is a competitive summer buying season," Odeta Kushi, First American's deputy chief economist, said in a statement. "The competitive home-buying market may influence homebuyers to misrepresent information in their loan applications to be more competitive when bidding for a home, creating an environment ripe for accelerating purchase fraud risk."

June's overall defect risk index was 61, down from 62

The refinance index was 52, compared with 54 in May; this tied the previous low point in February and March.

But the purchase component rose to 82, from 81 in May. It is the third consecutive increase in this index, which is now at its highest since June 2019, when it was at 83.

"Fortunately, low mortgage rates in June resulted in higher refinance demand," Kushi said. "Defect, fraud and misrepresentation risk is significantly lower on refinance transactions, so the reduced risk of fraud and misrepresentation in June is mostly due to the increasing share of lower risk refinance transactions within the mortgage market."

Refinance application volume was

"The housing market has proved resilient in the face of the economic damage caused by the pandemic," Kushi said. "Housing is one of the only major sectors to experience a V-shaped recovery, mostly due to the historically low mortgage rate environment enticing potential buyers to enter the market."