Home loan

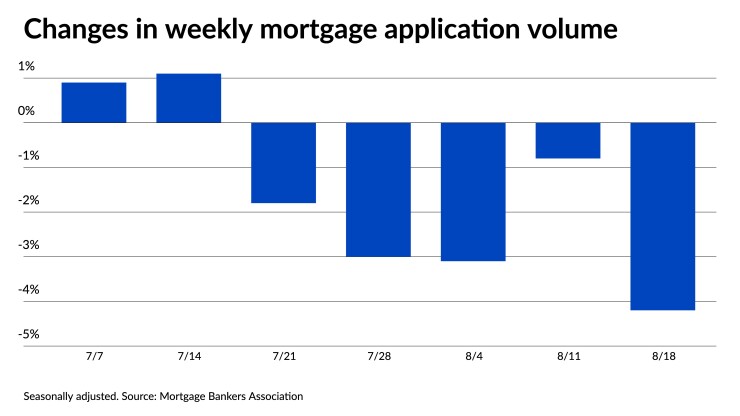

The MBA's Market Composite Index, a measure of weekly application activity based on surveys of the trade group's members, continued its recent downward descent, falling another 4.2% for the period ending Aug. 18. The two previous weekly surveys reported more muted drops of 0.8% and 3.1%. Compared to the same week in 2022, volumes were 31.6% lower.

Surging interest rates, again, provided consumers with

"Treasury yields continued to spike last week as markets grappled with illiquidity and concerns that the resilient economy will keep inflation stubbornly high. This spike pushed mortgage rates higher last week," Kan said in a press release.

The contract average for the 30-year conforming fixed-rate mortgage with balances below $726,200 in most areas leaped another 15 basis points week-over-week to finish at 7.31% — the highest since late 2000. A week earlier, the average sat at 7.16%. Borrowers also used 0.78 points on average, up from 0.68 seven days earlier, for 80% loan-to-value ratio loans.

The contract 30-year fixed rate for jumbo mortgages with balances above conforming amounts also accelerated to an average of 7.27% compared to 7.11% in the prior survey. Meanwhile, points increased to 0.84 from 0.55.

The spike in rates drove home-purchase application numbers to their lowest point since April 1995, "as homebuyers withdrew from the market due to the elevated rate environment and the erosion of purchasing power," Kan said. The seasonally adjusted Purchase Index fell 5% from seven days earlier. Activity came in 30% below levels from a year ago.

"Low housing supply is also keeping home prices high in many markets, adding to the affordability hurdles buyers are facing," Kan added.

Recent research from Zillow found rates would need to drop to 5% before many current homeowners would be willing to put their homes up for sale. While

The MBA's Refinance Index also dropped 2.8% from the prior week, with activity coming in 34.9% lower from the same week of 2022. But refinances took a 29.5% share relative to the total number, up from 28.6% seven days earlier due to the larger fall in purchases.

The slowdown in purchase mortgages also hit government-sponsored loan volumes after a recent uptick in some applications guaranteed by federal agencies. But although the seasonally adjusted Government Index slipped downward last week, the share of federally guaranteed mortgage applications picked up.

Loans backed by the Federal Housing Administration garnered a 14.3% share compared to 13.8% in the prior survey. Department of Veterans Affairs-sponsored applications accounted for 11.6%, edging down from 11.8% a week earlier. Mortgage applications coming through the U.S. Department of Agriculture took a 0.5% share, up from 0.4%.

With recent interest rate movements taking a larger bite out of what home buyers might be able to afford in August, purchase loan sizes fell last week. The average purchase-application amount saw a 2.2% drop to $407,700, its lowest mark since early January. One week earlier, the mean size came in at $417,200.

Average refinance amounts grew, though, by 1% to $254,500 from $251,900. The overall average for all applications stood at $362,600, 2% lower from $369,600 seven days earlier.

Consumer interest in adjustable-rate mortgages grew last week, though. "Some homebuyers are looking to lower their monthly payments by accepting some interest-rate risk after the initial fixed period," Kan said.

"The ARM share of applications increased to 7.6%, the highest level in five months, and the number of ARM applications picked up by 4% last week," he said.

With rates today more than twice as high compared to the mortgage boom of two years ago,

The hefty increases in mortgage rates among MBA lenders were not limited to the conforming and jumbo markets either. Two weeks after hitting a high last seen in 2002, the average contract rate of the 30-year FHA-backed mortgage accelerated to 7.09%, passing that peak after it had retreated to 6.93% in the last survey. Points also increased to 1.2 from 1.17.

The fixed contract average for the 15-year mortgage surged 15 basis points to 6.72% from 6.57% a week earlier. As they did for all other fixed loans, points increased, rising to 1.06 from 0.94 for 80% LTV loans.

The 5/1 adjustable-rate mortgage also saw its average increase by 30 basis points to finish at 6.5%, compared to 6.2% seven days prior. Rates on these loans stay fixed for a half decade before adjusting to market levels. In contrast to fixed-rate mortgages, though, borrower points on the 5/1 ARM dropped to 1.03 from 1.45.