DETROIT — Publicly traded mortgage technology firms seeking growth could eventually end up squaring off against or buying privately owned point of sale system startups.

"I think over time public players [become] material competitors or acquire them," Chris Gamaitoni, managing director at Compass Point Research and Trading, said during the Mortgage Bankers Association's technology conference in Detroit.

Private fintech companies may be on public technology companies' radar screens but some public mortgage technology company investors still haven't taken note of them.

"They say, 'Is it Ellie Mae or Black Knight winning?'" said Gamaitoni. "The question is, how do those public players continue that growth?" Eventually buying or competing against startup companies that offer point of sale systems or other new digital mortgage technologies may be one answer.

Technology firms have to offer more compelling value propositions to compete because lenders have tougher spending decisions to make given the business' lower profitability.

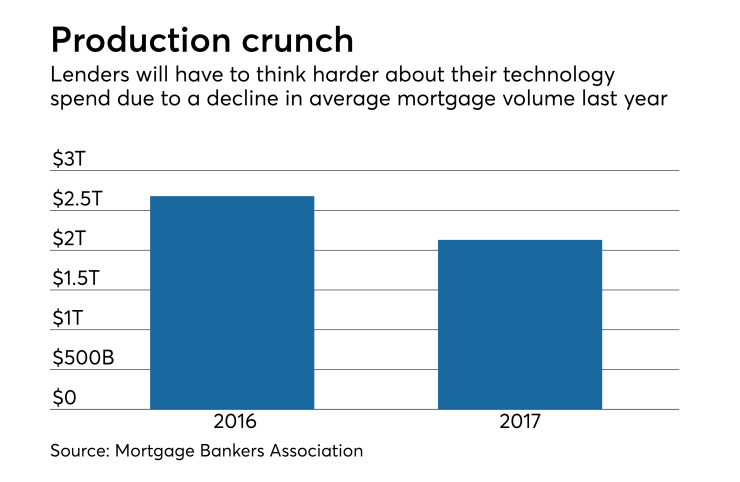

Mortgage bankers made just $711 per loan in 2017 compared to $1,346 a year earlier as heightened competition for scarcer originations and other factors that added to costs netted out revenue gains, according to the association. Average origination volume declined to $2.1 billion from almost $2.7 billion last year.

"In this environment I think it's more difficult," he said, noting that at least one lender

Lenders will be making decisions based on whether technology investments are "have to haves" or "nice to haves," said Gamaitoni. But he added, "I don't think there's any disagreement that the [new point of sale technologies] are a necessity."

Mortgage technology companies still could do very well in the current market, but it's likely not all of them will, Gamaitoni said.

"I think there are going to be clear, very large winners, but not everybody's going to win," he said.