Private mortgage insurance now has almost matched the Federal Housing Administration program in market share, having gained approximately eight percentage points in the past five years, Keefe, Bruyette & Woods found.

And that shift in credit enhancement for low down payment mortgages is likely to continue going forward, but not at the same pace, said analysts Bose George, Thomas McJoynt-Griffith and Eric Hagen.

"We believe that private MI growth will continue to remain strong over the next couple years, driven by sustained high penetration in the purchase market [and] led by a growing demographic of first-time homebuyers using government-sponsored enterprise loans," the analysts wrote.

"However, in order to be conservative, our earnings-per-share estimate assume that insurance-in-force growth trends down to the 6% range by the end of 2021 from the current 10% plus."

Total IIF grew by 1.8% over the second quarter and 6.4% year-over-year.

The FHA ended the third quarter with $1.23 trillion of insurance-in-force, a gain of 0.5% from the second quarter and 2.7% from the third quarter of 2018.

However, the nine private mortgage insurance companies — a group that includes six active firms and three others that still have books of business but no longer write new policies (Triad, Republic Mortgage Insurance Co. and PMI) — saw their IIF increase by 3.1%

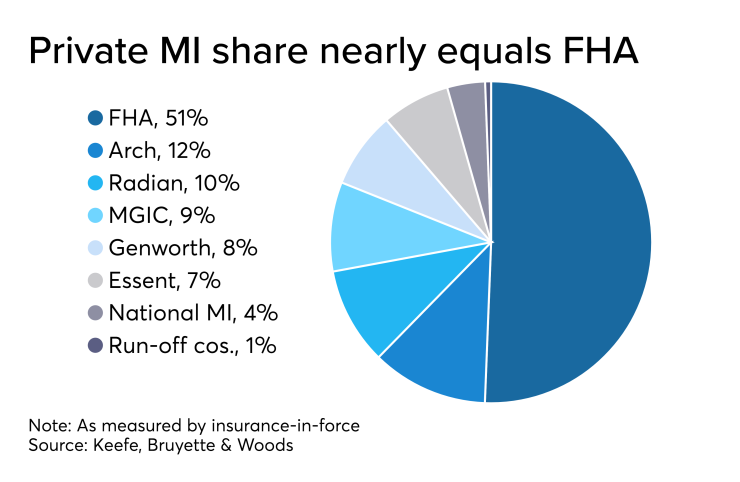

Their combined IIF is $1.2 trillion, giving them a total market share of 49.4%. At the end of last year, the private mortgage insurers had a 47.9% share, while for the third quarter of 2013 they had a 41.3% share and in

Over those five years, private MIs' insurance-in-force increased by $437 billion while the FHA's grew by $145 billion. Nearly all the FHA's growth took place after 2015; in 2014 and 2015, the government agency's IIF declined.

In the past year, the private companies have seen their IIF grow by $114 billion, while the FHA's increased by just $32 billion.