The non-agency mortgage-backed securities market in 2023 will go from "bad to worse," a Barclays Credit Research report declared.

"We expect RMBS to fall victim to broader risk widening in early 2023…outperforming corporate credit," said the report from Michael Khankin and Pratham Saxena. "Deterioration in residential credit is likely to put significant strain on late 2021 and early 2022 vintage collateral, leading RMBS to decouple further from broader risk spreads and lag in the subsequent recovery."

Barclays is forecasting 10% home price depreciation in 2023 and another 4% the following year. Moody's Investors Service, which also issued an MBS outlook, expects a 4% home price decline next year. However, CoreLogic, after a brief downturn in the spring, now predicts prices rising by 4.1% by next October.

Those borrowers in recent deals, unlike those in the 2008 or 2020 downturns, could experience unemployment and declining home prices without the ability to refinance out of their problems because of higher rates, Barclays said.

In a separate report, Moody's predicted that credit quality of newly issued and existing private-label MBS will weaken further in 2023, but that will be mitigated by the record-high home price appreciation of the past few years.

While delinquencies are expected to rise, those increased values will limit performance deterioration. Losses will rise with the end of pandemic-related forbearances along with foreclosure moratoriums, but Moody's believes those will remain at a low level.

Other positive factors are sound underwriting, origination and pooling practices. "More recently issued notes face higher risks, since they lack as much embedded appreciation, though often have had higher initial credit enhancement," the report said.

Collateral quality will also suffer as non-prime and non-qualified mortgages make up a larger share of PLS issuance.

In particular, mortgage borrowers for these loans will likely seek higher debt-to-income and loan-to-value ratios. Consumers are expected to increase use of products with payment-shock risks, such as interest-only loans and adjustable-rate mortgages.

"Loan pools for credit-risk transfer deals from government-sponsored enterprises Fannie Mae and Freddie Mac and others will also weaken somewhat," Moody's said. "Single-family rental securitizations' exposures to markets with falling prices are raising risks in the asset class."

PLS underlying mortgage prepayment rates will remain subdued. But those could rise in more recent deals if interest rates decline. Secondary market difficulties related to the spike in rates contributed to the closure this past year of

PLS issuance is expected to end the year significantly lower than in 2021.

"New deals slowed and, at times nearly froze, in [the second half of this year] after interest rates soared and spreads widened across more volatile financial markets," Moody's said. "Lower origination volumes will continue to depress issuance in 2023."

PLS issuance in 2021 was $202 billion, a post-financial crisis high, according to BofA Securities; in February,

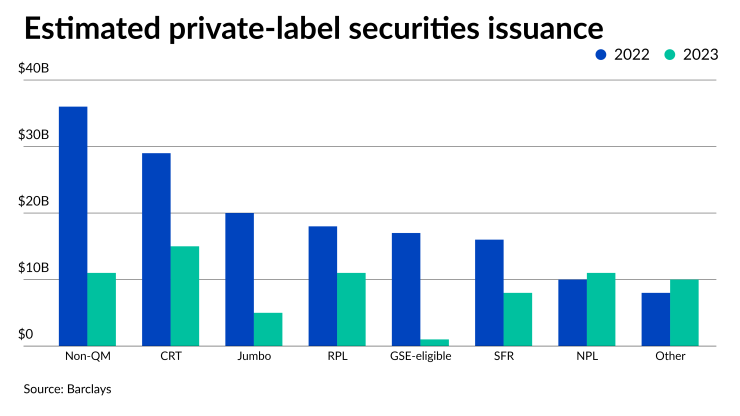

So far this year, PLS securitizations totaled $129 billion, according to Barclays. It expects the year-end total to be $154 billion. Barclays' 2023 estimate is for a mere $72 billion.

Kroll Bond Rating Agency recently predicted

Barclay's suggested PLS strategy for investors in 2023 is to avoid them or hedge the risk with credit default swaps.

"We suggest limiting exposure to late 2021 and early 2022 collateral in CRTs, where we think risk of losses and downgrades has yet to be fully priced in by the market," Barclays said. It predicts

The risk to Barclays' outlook is what happens with the macro economy. "If inflation declines quickly in 2023 without causing significant economic discomfort, significant upside exists," Barclays said. "However, there are probably better ways to position for that outcome than through non-agency RMBS."

Jumbo mortgages, whose volume in 2023 will be affected by the

"Demand from banks will continue to sap the supply of strong jumbo mortgages from the PLS market, especially if spreads stay wide," Moody's said, pointing to the inversion with conforming rates that had these loans priced at times as much as a full percentage point lower.

Barclays expects jumbo mortgage PLS issuance to fall to just $5 billion in 2023 from $20 billion for this year. GSE-eligible investor property-secured issuance is expected to drop to just $1 billion from $17 billion.

It predicts non-QM issuance of $11 billion in 2023, less than one-third of the $36 billion expected for 2022.