The

In just the first six weeks of the year, about 1.4 million borrowers lost the interest rate incentive to refinance. There are still 2.65 million potential refi customers likely to qualify and benefit from a loan refinance at current rates, but this is the smallest this population has been since 2008, prior to the initial rate decline during the recession.

Mortgage rates are challenging refinance loan volumes at a time when they were already shrinking. In 2017, refinance originations plummeted 29% from the previous year, with total volume down by $355 billion, or 34%.

The rate spike also contributed to a 6% increase in the median home price over the first six weeks of the year. To purchase a current median home, it requires 23% of a homebuyer's median monthly income, the highest this share has been since 2009.

Notably, homes in the lowest price tiers continue to see the greatest price appreciation rates, with properties in the bottom 20% seeing the quickest growth in prices for 67 consecutive months.

Affordability declines from rising rates could continue putting more pressure on lower-income buyers, who may face

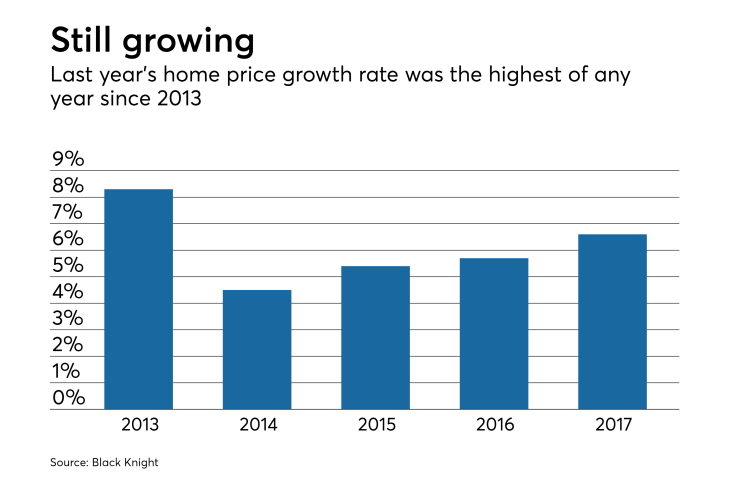

Overall in 2017, the median home grew $17,570 in value, the largest rise in dollar amount since 2006, and hit an all-time high of $283,000 at the end of the year.

January's median home value is 5.8%, or $15,400, greater than at the peak of the market in 2006.