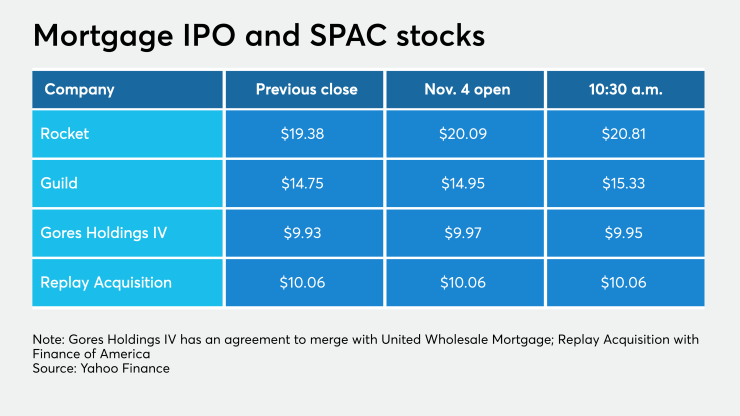

The uncertain outcome of the election had varying impacts on nonbank mortgage lender stocks, in the immediate aftermath of Election Day. The government-sponsored enterprises, Fannie Mae and Freddie Mac, saw a dip in prices, with their exits from conservatorship being intrinsically tied to the outcome of the presidential race. Meanwhile, heavy hitter Rocket Cos. saw a boost after the markets opened on Wednesday morning

After moving down $0.20 per share from its Tuesday closing price shortly after the markets opened,

The other company to recently go public, Guild Holdings, opened $0.20 per share higher at $14.95 and at 11:30 was at $14.81. Since the IPO on Oct. 22, Guild has closed at its

Gores Holdings IV, the special purpose acquisition company in a deal to merge with

On Tuesday, amid a broader run-up in the market as a whole — the Dow Jones Industrial Average rose 555 points — most mortgage and mortgage-related stocks posted gains.

However, uncertainty over the future of government-sponsored enterprises' planned exit from conservatorship apparently put a damper on investor enthusiasm for the GSEs. While Freddie Mac was up $0.03 per share after the market opened, it turned course and by 11:20 a.m. was down $0.10 to $1.80. Fannie Mae went from up $0.01 after opening to down $0.15 per share to $1.88.

If anything, a blue wave probably would have put downward selling pressure on Fannie Mae, a note written on Tuesday before the polls closed by Henry Coffey, Jay McCanless and Brian Violino of Wedbush Securities said.

"The only thing we can say about a blue (Democrat) or red (Republican) presidential victory and/or wave is that we do not see either party doing anything to hurt the robustness and liquidity of the mortgage market. Beyond this, opinion around which party is good for specialty finance stocks (in substance/fact), is probably just noise," the Wedbush note said.

Keefe Bruyette & Woods has a slightly different opinion regarding the impact on financial stocks.

"A contested election is not good for equities generally due to heightened uncertainty and is not good for financial stocks," KBW said. The company updated its recommendations to suggest investing in exchanges and mortgage operating companies.

"On the positive side, we expect the slide in mortgage operating stock, which has occurred recently, to subside," the report said. KBW has a broad definition for this category, which besides certain lenders, includes the private mortgage insurers and title insurers it follows.

The slide in mortgage stocks recently motivated Guild Mortgage to downsize its initial public offering and for Caliber Home Loans and AmeriHome

If the election remains contested, KBW lists Penny Mac Financial Services and First American Financial as mortgage operating company stocks to own and Radian and MGIC as stocks to avoid.

Penny Mac's stock had an initial drop on opening and by 9:53 had gained over $2 per share to $54.67.

KBW categorizes Redwood Trust, which is an originator of non-qualified mortgages and business purpose real estate loans, as a mortgage real estate investment trust and lists it as a stock to avoid. Redwood Trust opened in the red and in early morning trading remained below its Election Day close.

Under exchange stocks to own amid a contested presidential race, KBW lists Intercontinental Exchange, whose