PHH Corp. settled allegations of foreclosure process abuses with 49 states that involved "inconsistent signatures" and improper certification of servicing documents.

The Mount Laurel, N.J.-based company will pay $45 million, including $31.5 million that will go to borrowers whose homes were foreclosed on or who were put into foreclosure between Jan. 1, 2009, and Dec. 31, 2012.

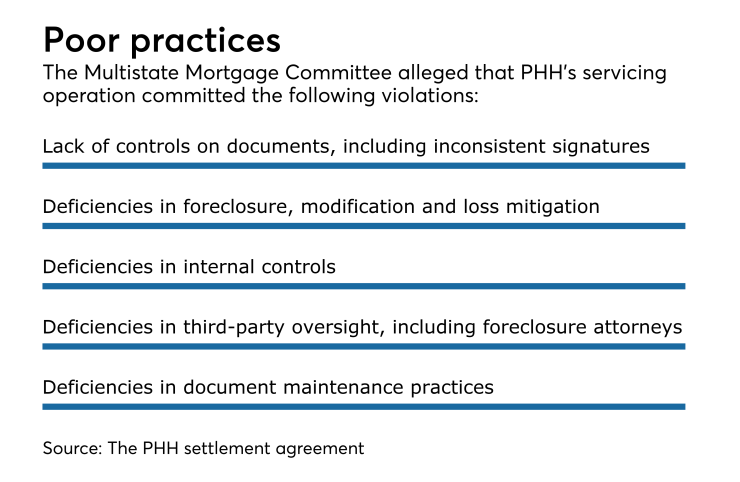

The allegations of misconduct by PHH Mortgage, a division of PHH Corp., were raised following a 2010 Multistate Mortgage Committee examination of its servicing activities. The MMC is a joint committee of the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators.

The examiners alleged PHH failed to exercise proper control over foreclosure documents, allowed unauthorized executions, inconsistent signatures, and improper certification and notarization. In addition, the examinations found deficiencies in other internal controls, loan servicing and mortgage modifications.

PHH did not admit any liability or wrongdoing in the settlement agreement.

"We have agreed to resolve concerns raised by the MMC arising from its servicing examination conducted in 2010 and believe that settling this matter is in the best interest of PHH and its constituents," the company said in a statement. "Our decision to resolve this legacy matter under the terms of the settlement agreement and consent orders is not an admission of liability or that we violated any applicable laws, regulations or rules governing the conduct and operation of our servicing business during the relevant time frame."

The allegations echo alleged misconduct that was pervasive among mortgage servicers during the height of the foreclosure crisis that eventually became known as "robo-signing" due to workers being

In addition to the monetary settlement, PHH agreed to adopt servicing standards and implement a testing and reporting process to ensure compliance.

"In fact, the servicing standards that we are required to adopt under the terms of the settlement are largely PHH's servicing standards today," the PHH statement reads. "We have made and will continue to make the necessary enhancements in our operations to ensure we remain compliant and continue to serve our customers in a fair and appropriate manner."

There are 52,000 borrowers nationwide that will receive payment from the settlement, including 3,800 in California, according to a release from the California Department of Business Oversight.

The settlement was structured in two separate agreements. One is between PHH and attorneys general for 49 states and the District of Columbia. New Hampshire is the only state that did not participate in this agreement.

The second agreement is between PHH and banking regulators from 47 states and the District of Columbia. Colorado, Florida and New York did not participate in this agreement.

In November 2016, PHH entered into

With this latest settlement, 1,600 New York residents will receive payments, according to a press release from Attorney General Eric Schneiderman.

Borrowers who were foreclosed on during the three-year period will qualify for a minimum $840 payment, according to the press release from Schneiderman's office. Borrowers who did not lose their home but PHH referred them into the foreclosure process will receive a minimum $285 payment.

This is a different case than the one involving PHH's

In another separate matter, PHH agreed to