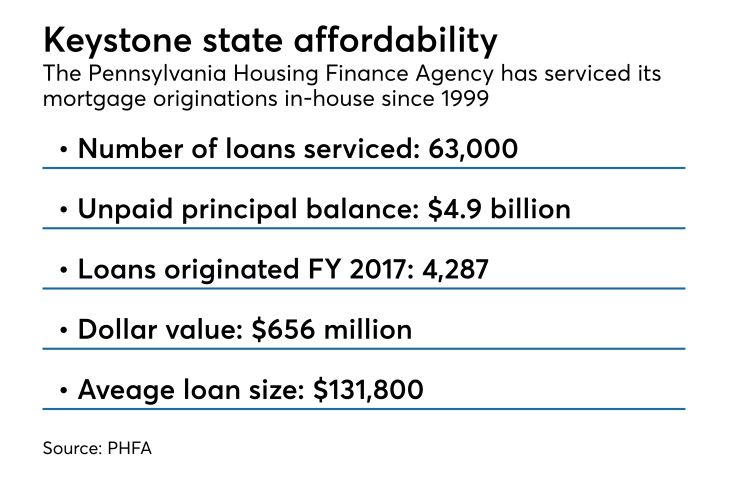

The Pennsylvania Housing Finance Agency is switching to Black Knight's LoanSphere MSP to service the agency's $4.9 billion mortgage loan portfolio.

The agency currently services about 63,000 loans. Since 1999, the PHFA has serviced its mortgage originations in-house; it is currently using the LSAMS platform.

It made 4,287 loans during fiscal year 2017 with a dollar value of $656 million. The average loan size was $131,800. It also made 1,718 loans to assist with borrowers with their down payment and closing costs.

"PHFA looks forward to working with Black Knight as we continue on our mission of providing capital for decent, safe and affordable homes for older adults, people on moderate incomes and others with special housing needs," Brian A. Hudson Sr., the agency's executive director and CEO, said in the Black Knight press release.

"We believe the company's technology provides the capabilities and support that will allow us to focus on growing our operations and improving the customer experience, while helping us maintain compliance."

The transition to LoanSphere MSP is expected to take place in the second quarter of 2019, a PHFA spokesman said.

The PHFA will also implement LoanSphere Servicing Digital, an interactive mobile tool providing detailed, timely and personalized information to PHFA customers about the value of their homes and how much wealth can be built from these real estate assets. The agency will also use LoanSphere Expedite's electronic signature and document fulfillment capabilities, its data and analytics, and the platform's suite of default servicing applications.

"We are pleased to provide a comprehensive, integrated approach to meeting PHFA's servicing needs," said Joe Nackashi, president of Black Knight. "Our flexible, scalable technology is now being used by multiple state housing authorities, as well as financial institutions of all sizes across the U.S., to help them manage their operations more efficiently and improve service to their customers."