Higher origination volume and lower costs revived mortgage lender profitability, despite a decline in per-loan revenue.

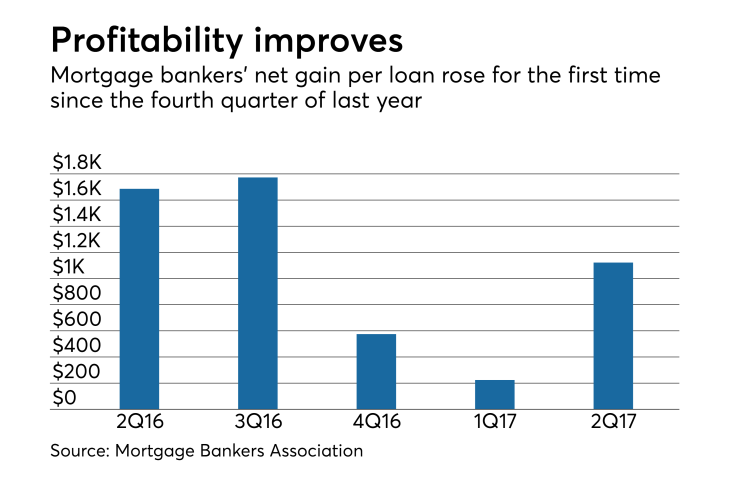

Independent mortgage bankers and mortgage subsidiaries of chartered banks averaged a net gain of $1,122 on second-quarter originations, up from

"Production revenues declined due to increased competition, but that was more than offset by per-loan expenses dropping to levels comparable with other recent quarters of similar volume," said Marina Walsh, MBA's vice president of industry analysis.

Total production revenue decreased to $8,896 per loan from $9,111 in the first quarter. During the second quarter a year ago, production revenue averaged $8,807 per loan.

Loan production expenses overall dropped to $7,774 per unit from $8,887 in the first quarter. Expenses include commissions, compensation, occupancy, equipment, as well as other production expenses and corporate allocations.

But those costs were still higher than they were during the second quarter last year when lenders spent $7,120 to originate a loan. Per-loan

The net gain per loan still isn’t as strong as it was during the second quarter a year ago, when the average per-loan profit was $1,686.

Profitability has been under pressure since the long-term rates most mortgages are pegged to increased after the federal election last year.

With slightly lower rates in the second quarter, servicing income dropped to $27 per loan. That was down from $225 in the first quarter, but up from a loss of $160 during the second quarter of last year.