Over one-quarter of all mortgages in the

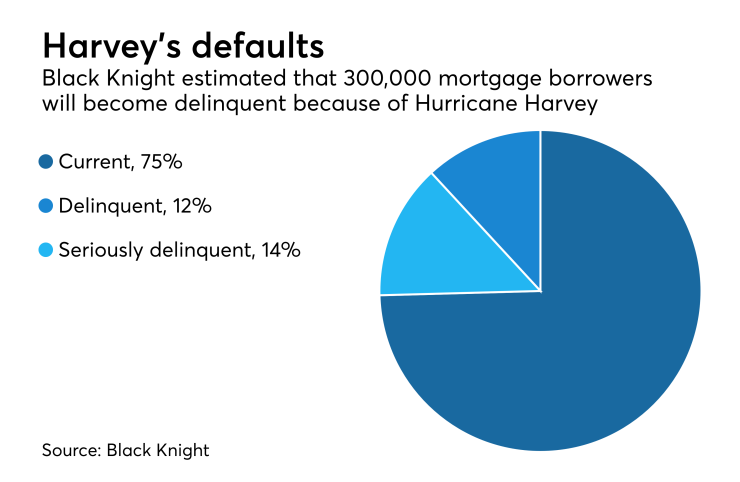

Approximately 300,000 mortgage borrowers will miss at least one payment on their loan because of the storm, with 160,000 not making three or more payments.

Black Knight modeled this estimate based on changes in the delinquency rate in Louisiana and Mississippi following Hurricane Katrina in 2005, said Executive Vice President Ben Graboske in a press release.

Mortgage delinquencies in affected areas in Louisiana and Mississippi peaked at 34%, with the rate of seriously delinquent loans peaking at 16%. But there were far fewer mortgage properties affected by Katrina than for Harvey, only 456,000 loans with an unpaid principal balance of $46 billion.

"There are 1.18 million mortgaged properties in Harvey-related disaster areas, more than twice as many as were hit by Hurricane Katrina, with nearly four times the unpaid principal balance (of $179 billion)," said Graboske.

"This will be a long-term recovery. If the Harvey-related disaster areas follow the same trajectory as those hit by Katrina, within four months we could be looking at as many as 160,000 borrowers falling 90 or more days past due on their mortgages."

Through July, the Houston-area had a 5.1% delinquency rate with seriously delinquent loans at 1.8%, Black Knight said.

There are moratoriums on foreclosures and

High loan-to-value ratio mortgages sold to Fannie Mae and Freddie Mac normally would be covered by private mortgage insurance in case of default. But the master policy that governs the relationship between the MIs and mortgage lenders specifically states that if physical damage was the principal cause of the default, it can deny a lender's claim made following the loan going into foreclosure.

The MIs are making an effort to work with lenders and borrowers in the affected area.

"Radian is committed to working with our customers to provide mortgage relief to homeowners who have been impacted by Hurricane Harvey; we're aligned with all of the GSE disaster assistance policies," Emily Riley, a company spokeswoman, said in a statement.

Historically MGIC has not seen any material impact as a result of natural disasters even though servicers may report higher delinquencies like in the case of Katrina, said spokesman Mike Zimmerman.

"Following the significant damage caused by Hurricane Harvey in Texas, Arch MI affirms our support for all forbearance and loss mitigation programs initiated by Fannie Mae and Freddie Mac. Arch MI has given servicers full delegation on Arch MI-insured GSE loans to proceed with workouts that meet the guidelines set forth by Fannie Mae and Freddie Mac. The servicer's only obligation is to report the workout once it is complete; permission is not required upfront," a statement from that company said.