Sandro DiNello's brief stint leading the troubled New York Community Bancorp is officially over.

DiNello, who joined NYCB when it bought his old company Flagstar Bancorp, is being removed as nonexecutive chairman this week. The shake-up, announced Tuesday, is the latest in a series of leadership changes amid efforts spearheaded by former Treasury Secretary Steven Mnuchin

DiNello stayed atop the company's board after a Mnuchin-led investment team

"Mr. Otting's appointment will better facilitate his ability, alongside the new senior executive leadership team, to continue to improve all aspects of the Company's operations and execute on its strategic initiatives," NYCB said in a news release Tuesday.

DiNello is staying on as a board director and senior advisor to Otting, and the company said his "strong banking knowledge will support" the bank as it executes on its turnaround strategy.

The

Some observers questioned why DiNello had remained in a leadership position despite the ouster of several board members during the Mnuchin-led capital infusion. DiNello was not responsible for the legacy NCYB business that has brought the bank so much trouble — a large concentration in loans to rent-stabilized apartment buildings in New York City.

But he was NYCB's nonexecutive chairman when the bank made the questionable decision to buy parts of Signature Bank after it failed in 2023. The acquisition came soon after NYCB had bought the DiNello-led Flagstar, and it put NYCB over the critical $100 billion-asset threshold.

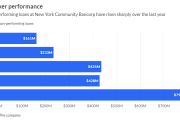

NYCB was far from ready to cross over that mark, which triggers additional scrutiny from bank regulators. Its troubles started in January, when it

NYCB was "not ready to be regulated" by the office of the comptroller of the currency, Otting

"We have a lot of catching up to do to get our standards up," Otting said in May. "But we're committed to doing that, and we've hired the people who understand what that looks like."

Otting has pushed out certain NYCB veterans and hired other experienced hands to replace them. Craig Gifford, the former corporate controller at U.S. Bancorp, is NYCB's new chief financial officer. Former OCC official Bao Nguyen is the bank's new general counsel and chief of staff.

Scott Shepherd and James Simons have also joined the company to handle issues in its commercial real estate portfolio. The two worked with Otting at OneWest Bank, which Otting and Mnuchin took over during the 2008 financial crisis and successfully turned around.

"We've done this before," Otting said in May. "And we feel we can do it again."

Last month, Otting

JPMorgan, the country's biggest bank, is buying the bank's $5 billion portfolio of warehouse loans. The companies said they expect the deal to close in the third quarter.