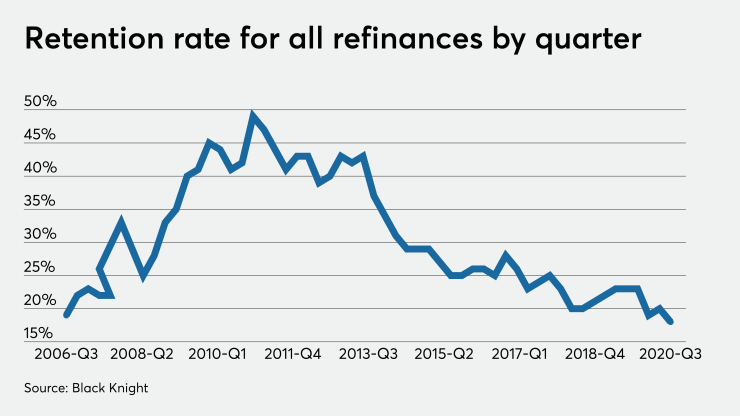

Average retention rates for refinances dropped to 18% in the third quarter, down from an upwardly revised 20%

Cash-out refinances had a particularly low average retention rate of 12% in the third quarter, when their market share fell to 27%, marking the lowest share in this category in seven years.

Rate-and-term refinances had a slightly higher retention rate of 22%. Home loans originated in 2018 and 2019 also had slightly higher retention rates at 25% and 26%, respectively.

These numbers put the average retention rate at a record low for the post-crisis period that followed the Great Recession.

Many companies may be less concerned about retention in the short term because demand is currently plentiful, and they may be getting plenty of volume from new originations.

Black Knight’s numbers suggest that if interest rates remain at current levels, volume will remain strong through the end of the fourth quarter, and possibly into next year.

About 19.4 million borrowers were considered strong candidates for financially advantageous refinance loans at the end of November, according to Black Knight. More than 6 million borrowers have refinanced so far this year, and rate-lock activity suggests that by year-end the total will be 9 million. During the third quarter, 2.7 million borrowers refinanced.

Black Knight forecasts that the dollar volume for originations will break a record in 2020, climbing above the $4 trillion and falling in line with the high end of the