Ocwen Financial Corp. took a net loss of $44.4 million in the second quarter related to legal and other expenses, including the wind down of its correspondent lending unit.

The West Palm Beach, Fla.-based company's latest results compare to a

Ocwen last turned a profit in the third quarter of last year when it generated

"Despite the regulatory setbacks, we made progress during the second quarter on a number of fronts," said President and CEO Ron Faris in a press release.

"We signed our agreements relating to mortgage servicing rights transfer and subservicing with

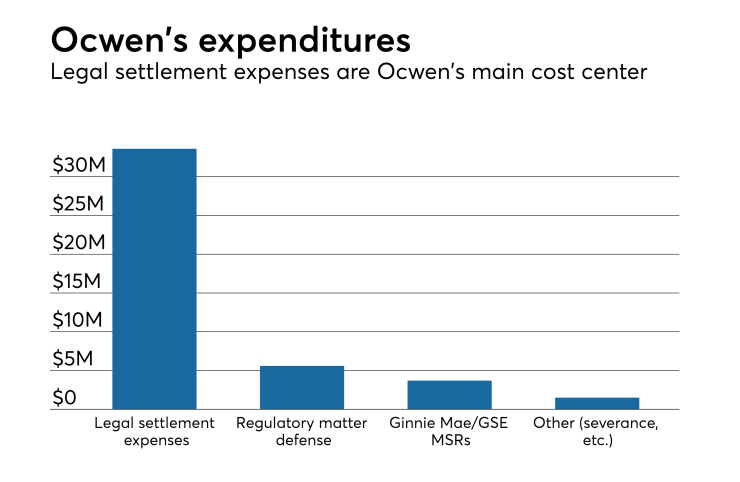

Significant components of Ocwen's loss included $33.6 million in legal settlement-related expenses, $5.6 million in regulatory matter-related defense costs, $3.7 million in negative changes related to Ginnie Mae and government-sponsored enterprise mortgage servicing rights, and $1.5 million in other expenses, including severance.

A number of the company's legal battles continue to play out in court, including its court challenges to a Consumer Financial Protection Bureau lawsuit and a lawsuit filed against Fidelity Information Services related to a regulatory audit of the company FIS conducted on the California Department of Business Oversight's behalf.

A judge this week granted Ocwen's motion to invite the U.S. Attorney General to share his view on constitutional issues

The company's servicing segment generated $9.2 million in pretax income but its lending segment took a $600,000 pretax loss as its volumes declined 26.1% year-to-year and it exited the correspondent loan channel.

Ocwen's servicing results marked a $21.4 million improvement over 2Q 2016 and its lending results represented a $5.6 million decline compared to 2Q 2016.