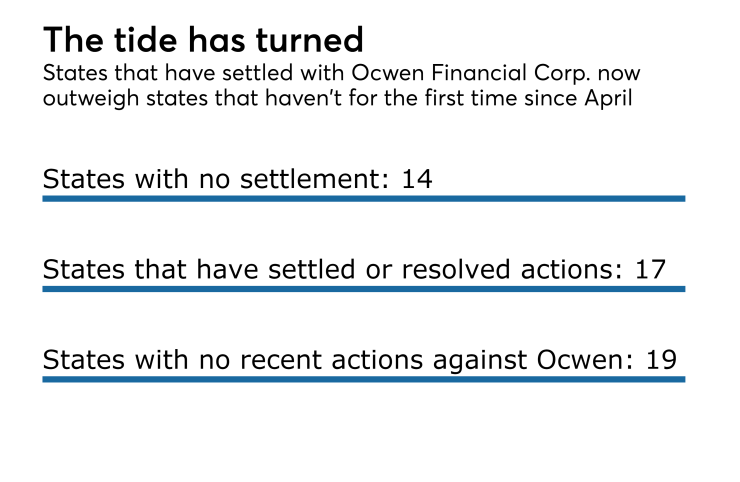

Ocwen Financial Corp. is settling allegations by Alabama and Minnesota that it engaged in improper mortgage activities, bringing the total of states it has settled with to 17.

"We continue to work cooperatively with the remaining 14 state regulatory agencies and two state attorneys general to reach acceptable resolutions," said John Lovallo, a spokesperson for Ocwen, in an emailed statement.

As in

Other states that have settled, withdrawn regulatory actions or allowed them to expire include Georgia, Idaho, Illinois, Maine, Michigan, Mississippi, Montana, Rhode Island, South Carolina, Wisconsin, Indiana, Nevada, Virginia, West Virginia and New Mexico.

Ocwen also recently engaged Chris Whalen, a consultant who has claimed the company has been

The company has neither confirmed nor denied liability in any of its settlements, or paid any fines or penalties, although Ocwen will incur costs related to the business measures it agreed to as part of the settlements.

The settlements do not end lawsuits several states and the Consumer Financial Protection Bureau

Prior to the April lawsuits, Ocwen had reached an agreement