Ocwen Financial took nearly a $30 million net loss in the second quarter due to expenses ahead of its PHH Corp. acquisition that outpaced its mortgage servicing profits.

The company's results improved on its net loss of more than $44 million

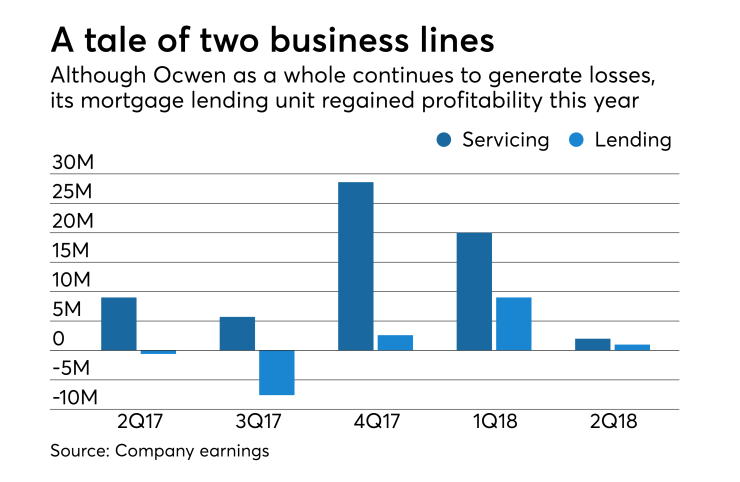

Ocwen's corporate segment took a $32 million net pretax loss, but the company also generated more than $2 million in pretax servicing income. This was down from more than $9 million a year ago and more than $20 million the previous quarter. Lending income rose to more than $1 million from a $600,000 loss in the second quarter of last year but was down from nearly $9 million in the first quarter.

"In the second quarter of 2018, Ocwen has remained focused on four areas: helping homeowners, resolving legacy regulatory and legal matters, investing excess cash and preparing for our merger with PHH," CEO John Britti said in a press release. "We have made progress in all four areas."

"Our primary emphasis, however, has been on developing our plans for integration upon closing of our

PHH previously cleared a key hurdle to the acquisition by generating

New Residential Investment Corp., which has been one of Ocwen's