Ocwen Financial Corp. has gotten the go-ahead to acquire PHH Mortgage Corp., subject to revised New York restrictions on acquisitions of mortgage servicing rights, and other conditions imposed by the state.

"The parties have now received all regulatory, governmental entity and contractual

Ocwen may now acquire MSRs from New York loans, so long as they are boarded onto Black Knight's system rather than onto the embattled in-house system the company is

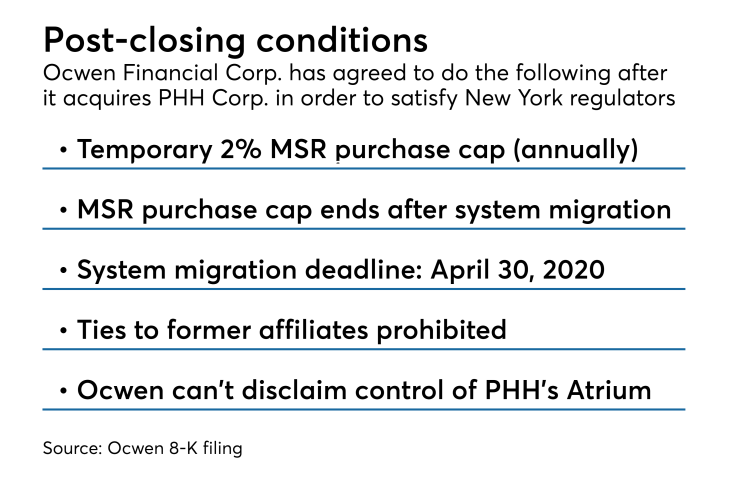

The servicer also is prohibited from increasing its New York MSR purchases by more than 2% annually until the migration is done, and until it has infrastructure that supports the onboarding of "sizeable" portfolios. The migration of all New York loans must be complete by April 30, 2020.

Ocwen must furthermore document, audit and report on the migration, which has to include procedures through which it can address any related consumer complaints in the state, maintain compliance and manage risk. The company must report on consumer complaints for three years.

New York additionally will restrict and supervise Ocwen's senior management and any appointments the company makes to the board. The NYDFS prohibits company ties to former affiliates that were subject to

A disclaimer of control request related to PHH Corp.'s subsidiary,

NYDFS conditions were detailed in Ocwen's 8-K filing with the Securities and Exchange Commission.

The acquisition is on track to close in 10 days.