Ocwen Financial finalized the deal to sell its interests in $110 billion of nonagency mortgage servicing rights to New Residential Investment Corp. for total consideration of $400 million.

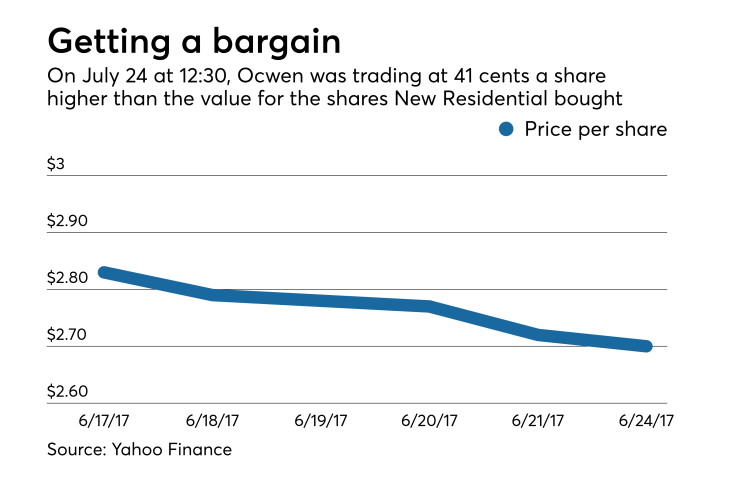

As part of the transaction, Ocwen sold 6.1 million shares of its common stock, approximately 4.9%, at $2.29 per share, or $13.9 million in proceeds. The per-share amount was based on Ocwen's April 28 closing price.

As of 12:30 p.m. on July 24, Ocwen was trading at $2.70 per share.

Negotiations between the two companies

On July 20, Ocwen

Back on May 1, the MSR portfolio was estimated to be $117 billion but amortization brought that down by $7 billion, the New Residential press release said.

New Residential owns the economics and servicer advances on these MSRs having obtained them when it

Ocwen will subservice this portfolio for five years, under a new agreement that replaces certain existing arrangements between the two companies.

Prior to transferring the MSRs, Ocwen would need to obtain the consent from the related securitizations' counterparties. If it fails to obtain those by July 23, 2018, those MSRs either could be subject to a new agreement to be negotiated by Ocwen and New Residential, purchased by Ocwen at a price to be determined, sold to one or more third parties, or remain subject to the existing agreement, an 8-K filing by Ocwen said.

New Residential will pay a lump-sum restructuring fee upon the transfer of the MSRs in exchange for Ocwen forgoing payments under the existing agreements, the 8-K said.

New Residential agreed to an 18-month standstill period on its right to replace Ocwen as the servicer of the MSRs. After the initial term, the agreement can be extended at New Residential's option for three-month periods on an ongoing basis.

"We believe the new subservicing arrangement will further secure our interests in our MSR investments and provide additional stability to the overall servicing industry," said New Residential Chairman and CEO Michael Nierenberg in a press release.

"We are encouraged by the performance of our investment portfolio to date and remain optimistic in our ability to continue driving shareholder value going forward."