Ocwen Financial reported its first full-year profit since 2013 in its latest earnings call, but also noted it slipped back into the red during the fourth quarter.

The $2 million loss Ocwen reported for the quarter under generally accepted accounting principles was down from net income of $22 million in

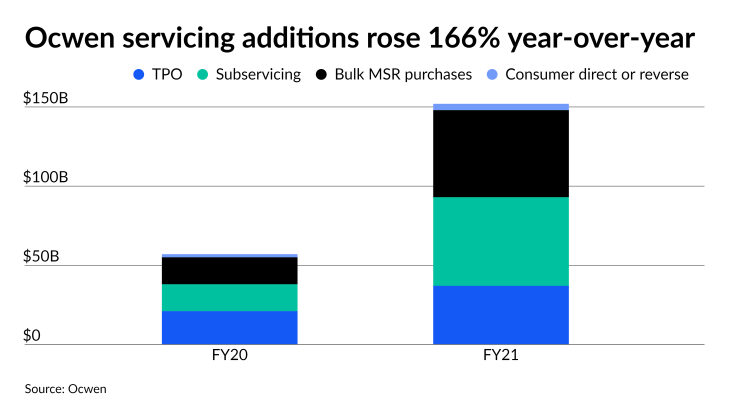

Prominent in the company’s earnings was a large gain in its servicing volume due to a 166% increase in acquisitions during the year, which helped it scale costs. The company staged acquisitions through third-party origination, subservicing, bulk, consumer-direct and reverse mortgage channels that totaled $152 billion, up from $57 billion during the previous full-year period. In total, the unpaid principal balance of servicing Ocwen recorded for the quarter was $268 billion.

“We delivered record total servicing additions, double-digit growth in our highest margin channels, and solid operational execution,” President and CEO Glen Messina said during the company’s earnings call. “We achieved our recapture rate objectives in consumer direct and cost reduction in servicing was ahead of target.”

The company generated $246 million in revenue during the quarter, up 26% from $195 million a year earlier, but down slightly from $248 million the previous fiscal period.