Nonbanks made the majority of the purchase and refinance loans in the market during 2016 for the first time in decades, according to annual Home Mortgage Disclosure Act data released Thursday.

"For the first time since at least 1995, nondepository, independent mortgage companies accounted for a majority of each of these types of loans," Federal Reserve economists Neil Bhutta, Steven Laufer and Daniel Ringo said in a report analyzing the data.

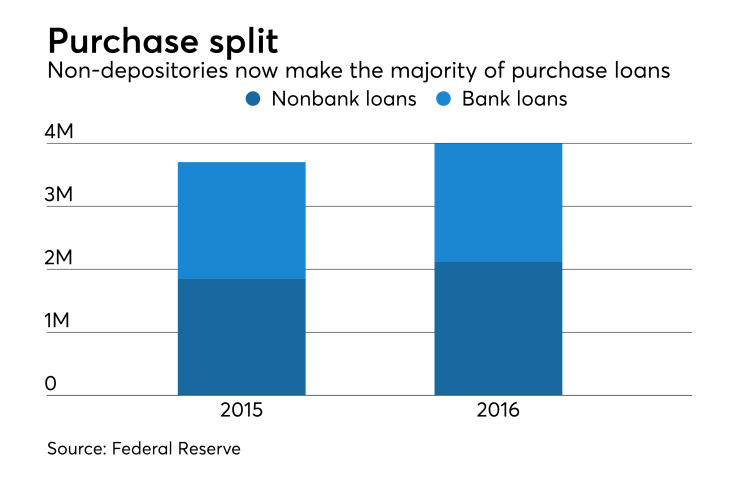

The share of the first-lien, owner-occupied purchase mortgages made by nonbank mortgage companies rose to 53% from 50%, according to the Fed’s analysis of the data. Nonbanks also made 52% of refinance loans, up from 48% the previous year.

During 2016, the share of originations and racial minorities' purchase mortgages kept rising even though the number of lenders fell and denial rates remained higher for African-Americans and Hispanics.

Lenders made 8.4 million loans last year, up 13% from the 7.4 million they made

Purchase loans increased 10% to 4 million from 3.7 million and the number of refinances increased 16% to 3.8 million from 3.2 million, according to the Fed analysis.

The share of purchase loans made to African-American borrowers rose to 6% from 5.5% the previous year, while Hispanics represented 8.8% of borrowers who took out loans to buy single-family homes, up from 8.3% in 2015. This marked the third consecutive annual rise in purchase volume for these groups.

Hispanic borrowers' share of the refinance market remained steady at 6.1% and the percentage of refinance loans made to African-Americans plateaued at 4.9%, according to the examination council's data.

Denial rates for conventional home-purchase loans were about 22% for black borrowers, 15% for Hispanics, 11% for Asian borrowers, 17% for other minority borrowers and 8% for white borrowers, according to the Fed.

The percentage of new higher-priced mortgages in the market fell during the past year to 5.5% of the market from about 6% the previous year.

During 2016, the number of reporting institutions fell about 2% to 6,762 as the mortgage business continued to consolidate.