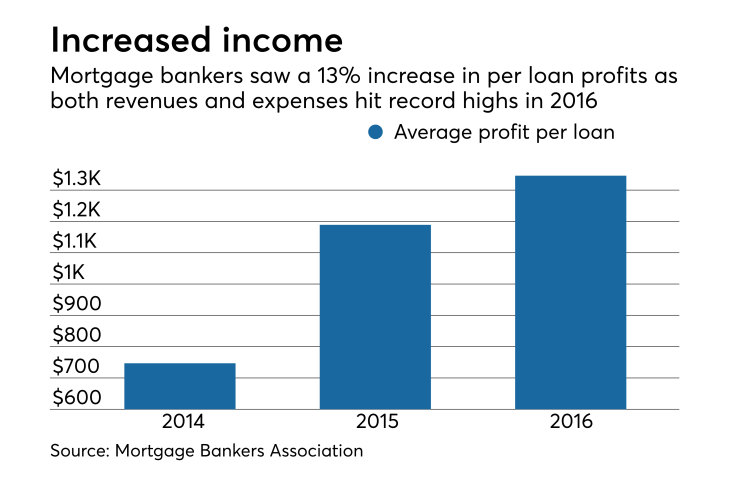

Per-loan profits for nonbank lenders increased over 13% in 2016 from the previous year, driven by higher loan balances and increased revenue.

Independent mortgage bankers earned an average of $1,346 per loan, as average loan balances were at $244,945, the all-time high for the Mortgage Bankers Association's annual survey. In 2015, they earned $1,189 per loan.

As a result, revenue per loan was a record $8,555, said Marina Walsh, MBA vice president of industry analysis, in a press release.

"Yet production expenses also reached a study-high, at $7,209 per loan, and offset a portion of these revenue improvements. The net result was a slight increase in overall net production income," she added.

Average net production income was 58 basis points in 2016, compared to 52 basis points in 2015. Including fee income, second market income and warehouse spread, total production revenue was 366 basis points in 2016, up from 359 basis points the previous year.

Because of interest rate movements during 2016, mortgage servicing rights owners saw net losses from this asset in the first half of the year, but a recovery in their value after the election.

Even so, net servicing financial income, which includes net servicing operational income as well as MSR amortization and gains and losses on MSR valuations, was $34 per loan in 2016, down 53% from $73 per loan in 2015.