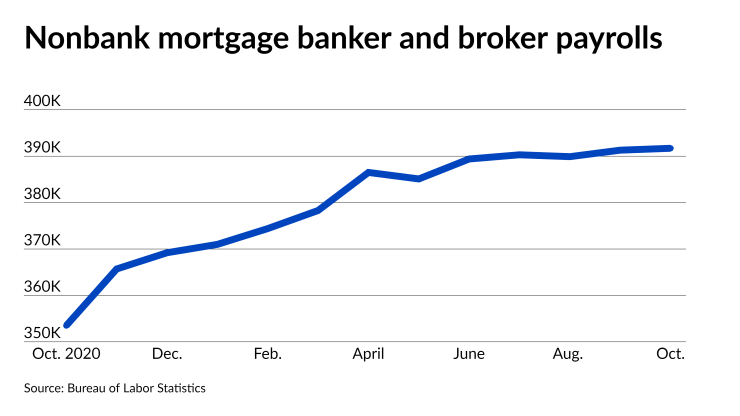

The employment estimates for nondepository lenders show a flattening trend through October as news of job cuts at individual companies made headlines this week.

Nonbank mortgage payroll estimates did eke out a small net gain, rising slightly to 391,700 from an upwardly-revised 391,300

“Cost cutting is again becoming a priority for issuers and vendors as we head into 2022,” said Chris Whalen, chairman of Whalen Global Advisors, an NMN columnist, and former senior managing director at Kroll Bond Rating Agency, in an email. (Whalen also is an investor in industry stocks and has short positions in some of them.)

With a larger number of nondepository lenders having gone public amid the past year’s unprecedented — but now waning — refinance boom, the industry also could be under pressure because it’s partially dependent on a stock market that’s looked less favorable recently, Whalen noted in a recent report.

“Secondary stock offerings for all issuers, including [independent mortgage banks], have basically disappeared in the past several months,” he said in his blog, The Institutional Risk Analyst.

Overall, mortgage originations will likely drop by roughly one-third to $2.6 trillion in 2022 from more than $3.9 trillion this year after topping $4 trillion in 2020, according to the Mortgage Bankers Association.

On the bright side, if construction hiring remains sufficiently strong, home purchase originations, which are on track to grow to $1.7 trillion from $1.6 trillion next year. The latest numbers in that sector, which the BLS reports with less of a lag than nonbank mortgage estimates, suggest it’s accelerating. The month-over-month increase in residential building construction jobs was 0.46% in November, compared with month-over-month increases of 0.12% in October and 0.32% in September.

“Builders are facing supply-side headwinds that make it more difficult and costly to build” First American Deputy Chief Economist Odeta Kushi said in an email. “A shortage of skilled workers is one of those headwinds, so today’s report, indicating growth in both residential and non-residential building jobs, is welcome news for this labor-intensive industry, and for a housing market in desperate need of more supply.”

Construction hiring will likely continue to climb to keep pace with consumer demand. That suggests the seasonally-adjusted annual rate of residential housing starts could rise next year to 1.64 million from 1.58 million, driven primarily by single-family activity, according to the MBA. Starts in that component of the market are on track to account for much of that growth as they rise to 1.2 million from 1.1 million.

“More workers are needed to support the pickup in home construction MBA is

Although overall hiring was weaker than expected in November, when variants refueled concerns about the coronavirus, Fratantoni characterized the long-term employment outlook as generally positive.

“The headline nonfarm payroll gain of 210,000 jobs in November was smaller than anticipated. However, as has been the case several times this year, there are reasons to believe that this understates the improvement,” he said. “Almost 6 million more people are employed compared to last November.”

The unemployment rate across all industries fell by 0.4 percentage point in November from the previous month to 4.2%. While this may be overstated by as much as 0.1 percentage point by a misclassification error that’s been in effect since March 2020 and remains higher than unusually low pre-pandemic levels around 3.5%, Fratantoni noted that it also generally bodes well for hiring and consumer demand for housing.

“The large decline in the unemployment rate to 4.2%, the increase in the labor force participation rate, and the almost 5% year-over-year gain in average hourly earnings all highlight the tightening job market. Coupled with the still elevated number of job openings, this suggests that the economy is getting closer to full employment,” he said.