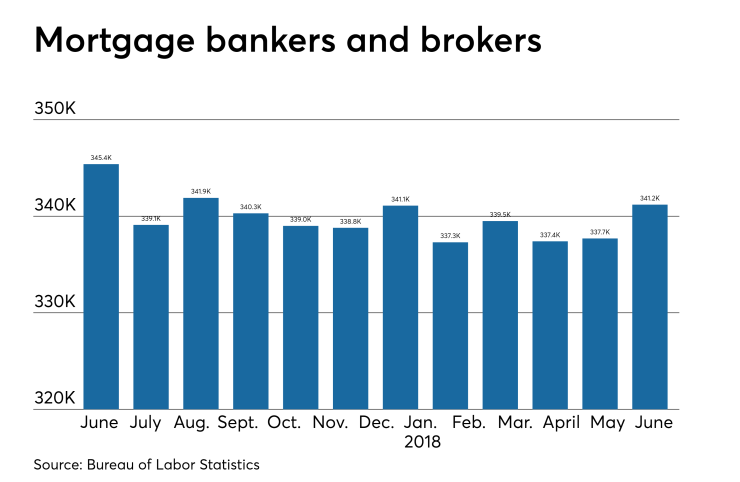

Employment by nondepository mortgage companies in June increased for the third consecutive month as seasonal hiring continued even though home resales inched down another notch.

Nonbank mortgage lenders and brokers employed 345,400 people during the month, according to the Bureau of Labor Statistics. In comparison, nondepositories employed 339,600 people

Although June typically is a busy month for home sales, purchases of pre-owned homes declined due to factors that include limited inventory, higher year-over-year mortgage rates and increases in home prices that outpaced wage growth.

Nonbank mortgage employment estimates lag national jobs data by a month. The nation as a whole added 157,000 jobs across all industries in July, fewer than in June when an upwardly revised 248,000 jobs were added, and in May when an upwardly revised 268,000 workers were added to payrolls.

The unemployment rate in the United States dropped to 3.9% in July from 4% in June.

"Homebuyers should feel a bit more confident today after the Bureau of Labor Statistics' employment situation report for July stated that the unemployment rate edged down," Mark Fleming, chief economist at First American, said in a press release.

An increase in wages that occurred in June also could help the housing market even though it remains below the pre-recession rate of growth, he added. Average hourly earnings were up 2.7% year-to-year during the month for production and nonsupervisory employees.

"House price appreciation has exceeded wage growth for six years, so any signal that wage growth may be closing the gap is good news," said Fleming.

Residential construction employment also was higher during the month, but it is still "unlikely to keep up with building demand, which suggests no meaningful relief from the housing supply crunch in the second half of the year," Doug Duncan, chief economist at Fannie Mae, said in a statement.