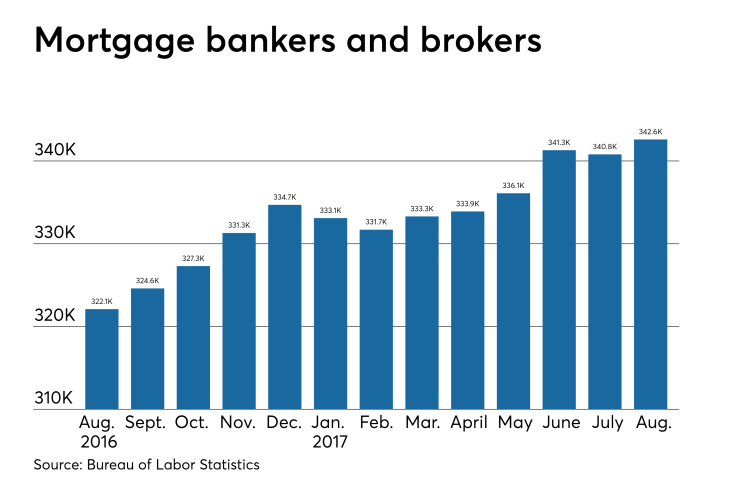

Nonbank mortgage employment increased in August and July's dip was less than originally estimated, according to the Bureau of Labor Statistics.

Nondepository mortgage lenders and brokers added 1,500 employees to their payrolls in August, bringing total employment in the sector to 342,600 in August from 341,100 in July, the Bureau of Labor Statistics reported Friday. The

This increase in hiring indicated demand for mortgages was strengthening as Hurricane Harvey struck the Texas coast on Aug. 25.

However, Friday's job report shows the one-two punch of Hurricanes Harvey and Irma (that hit Florida two weeks later) simply stalled most hiring in September. Total nonfarm employment fell by 33,000 jobs in September after the economy added on average 172,000 jobs per month over the past 12 months, according to the Bureau of Labor Statistics.

Yet the overall unemployment rate fell to 4.2% in September from 4.4% in August. Industry-specific employment data lags national data by one month.

Going forward, Fannie Mae economists expect a slowdown in mortgage lending activity in the fourth quarter with purchase lending dropping to $263 billion from $306 billion in the third quarter and refinancing activity falling to $131 billion in the fourth quarter from $113 billion in the prior quarter.

"Unfortunately, we continue to expect home sales to be flat during the second half of the year compared to the first half due to strong house price appreciation and lean inventories," according to Fannie Mae economists.

There is already a limited supply of construction workers and the rebuilding effort in the wake of the hurricanes will

"Unfortunately, housing shortages will last longer and home prices will no doubt continue to outpace wage growth for the foreseeable future," Yun said in a statement Friday.