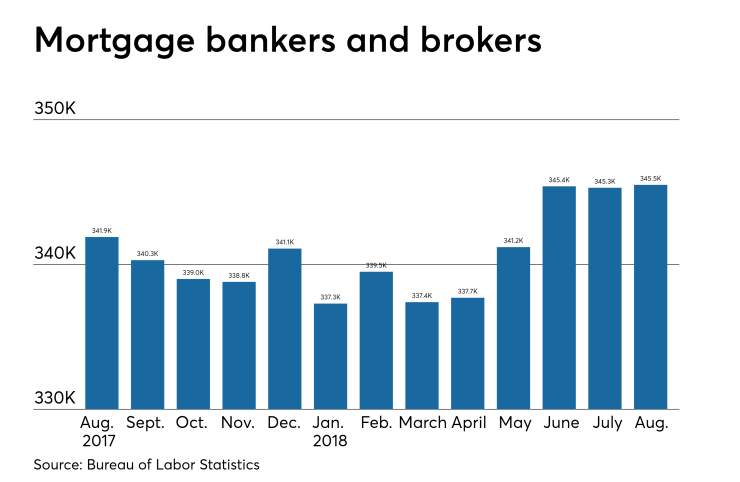

Hiring by nonbank mortgage lenders and brokers reversed course again and got slightly higher in August as originators made a last-ditch effort to reach seasonal homebuyers before fall.

Nonbank mortgage brokers and lenders employed 345,500 people in August, according to the Bureau of Labor Statistics. There were 345,300 people employed by nonbank mortgage production companies

Some nonbanks like

Historically, home purchases tend to slow in August as many families with children preferred to be settled ahead of the start of the school year. However, with affordability under strain, more buyers are waiting until August to purchase a home because they know prices could be lower then.

In addition to nonbank mortgage hiring, month-to-month home price appreciation was slightly higher in August. However, appreciation was slower

In contrast, employment in the nonbank mortgage production industry was up from the previous year in August, as well as on a consecutive-month basis. Nonbank mortgage lenders and brokers employed just 341,900 workers during the same month a year ago.

Estimates for additional employment across all industries, which the nonbank mortgage lender and broker estimates lag by a month, show only 134,000 jobs were added in the U.S. as a whole during September, when

The overall unemployment rate in September fell slightly to 3.7% from 3.9% in August. In September of last year, the unemployment rate was 4.2%.

"The unemployment rate fell to the lowest level since the end of 1969, as the gain in employed persons outpaced the increase in the labor force," Doug Duncan, chief economist at Fannie Mae, said in an emailed statement about the jobs data. "Today's release, when combined with other recent reports on the labor market, suggests that the Fed will continue to raise rates at a gradual pace in line with its risk management approach of not removing accommodation too quickly and needlessly shortening the expansion, but also not moving too slowly and risking rising inflation and inflation expectations."

"Consistent with the top line reading, job growth in residential construction also slowed noticeably, likely reflecting the hurricane’s impact," he added. "However, any lost construction jobs associated with the hurricane should be recouped as the affected areas recover."