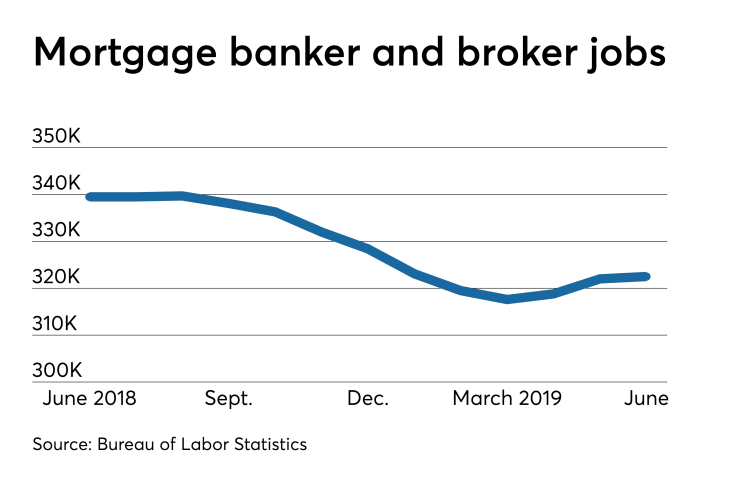

June employment by nondepository mortgage bankers and brokers was little changed from the previous month, but later numbers could prove stronger given some influential lenders' interest in staffing up.

Nonbank mortgage brokers and bankers added 500 people

But with some nonbank lenders making ambitious hiring plans and forecasts calling for further declines in mortgage rates, a pickup in mortgage employment could surface later.

"In July, low mortgage rates of 3.8% and rising wages (which translate into higher household income), helped increase consumer house-buying power over the previous month. Furthermore, the recent rate cut by the Federal Reserve prompted the 10-year Treasury yield, which influences mortgage rates, to nearly three-year lows," Odeta Kushi, deputy chief economist

"Further decreases in mortgage rates could be on the way. Combined with the strength of the labor market, potential homebuyers may see their house-buying power continue to grow in the months ahead."

Some lenders are expecting sustained growth in originations as a result.

Notably,

In addition, New American Funding in Tustin, Calif., plans to add a total of almost 1,000 positions in its corporate headquarters, branches and call centers.

While there was some interest in hiring within the nonbank mortgage industry in July, the numbers for overall employment were not that strong.

An additional 164,000 people were employed across all industries in July, according to the BLS, which reports nonbank mortgage data with a one-month lag. This marked a decline from an addition of 193,000 jobs in June, but was up from an addition of 62,000 jobs May. The BLS made downward revisions to both its May and June estimates.

But current numbers for gains in overall employment are stronger than they were in July of last year, when an additional 147,000 people were added to the payrolls.

Unemployment remained unchanged relative to the previous month at 3.7%, but was down slightly from 3.9% a year ago.