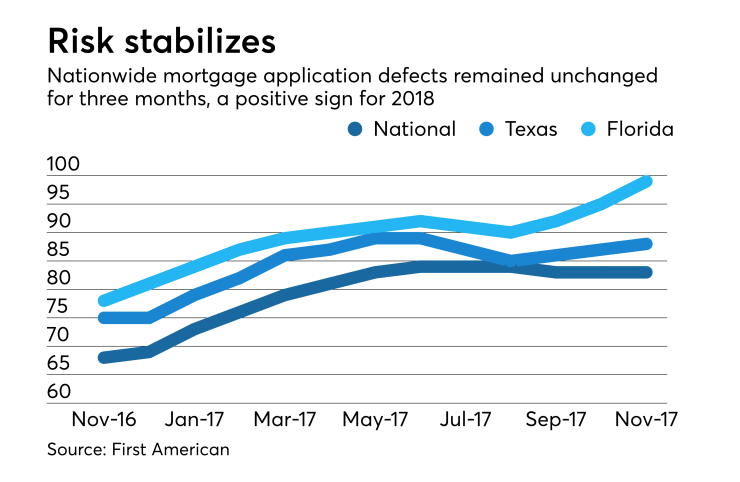

After surging earlier in the year, the number of mortgage loan application defects remained flat in November, a positive sign when it comes to fraud incidents going forward.

The First American Loan Application Defect Index

"As 2017 ends and we look forward to 2018, there is reason to be optimistic about defect, fraud and misrepresentation risk," Mark Fleming, First American's chief economist, said in a press release. "Keep in mind that the Loan Application Defect Index was at its lowest point ever in November 2016, before defect risk surged by 24% in the following seven months, one of the fastest changes the defect index has recorded since its inception in 2011.

"The increase was primarily driven by an increase in the share of purchase mortgage transactions, which tend to carry more risk, and more transactions in riskier markets. This fall, we have seen some moderation and stabilization of these market dynamics and, as a result, no further increase," he said.

Defects on purchase applications were up one point to 91 compared with October, while for refinances, they were flat at 69.

Florida and Texas had been of particular concern for application defects in recent months because of a correlation between

While Texas had only a 1-point increase in fraud risk from October to 87, the index for Florida increased 4 points from October and 21 points year-over-year to 99.

Florida was one of five states on Fleming's "naughty" list, with the fourth-highest index value, behind Arkansas, Idaho and North Dakota. Montana was ranked fifth.

"As the Defect Index map shows, defect risk, or the lack thereof, is clearly concentrating regionally. The Northeast and California are generally low risk, while the South, Southeast and upper Midwest are generally higher risk," Fleming said.

The states on the "nice" list were New Hampshire, Connecticut, Massachusetts, Pennsylvania and Maine.