Nexera Holding in Emeryville, Calif., is rebranding itself under the name of its Newfi online mobile-enabled lending channel.

"Unifying under the Newfi Lending name reflects our strong focus on technology," said CEO Steve Abreu in a press release.

The company's wholesale division, Blustream Lending, will be rebranded at Newfi Wholesale.

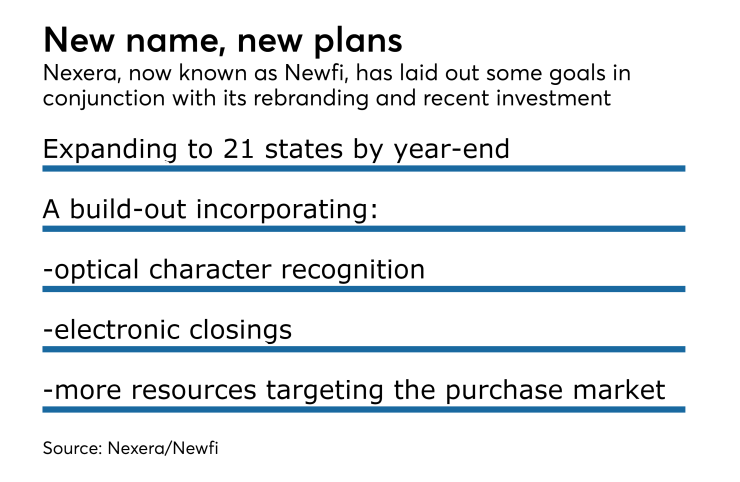

Newfi is licensed in at least a dozen states and plans to expand that total to 21 by year-end.

Funds affiliated with private equity firm Warburg Pincus agreed to invest in Nexera's expansion and its technology platform in January. The amount of the investment and the terms were not disclosed.

"Steve and the team at Nexera are disrupting the traditional mortgage market by building a next-generation origination platform," said Eric Friedman, a principal at Warburg Pincus, in an earlier press release about the investment.

The company's online lending is done through proprietary technology and it operates using a

"The functional build for this year will be centered around e-closings, OCR, data from the source and expanded resources for purchase customers," said Abreu. The functionality will be extended to both business channels, he said.

Newfi's wholesale channel offers 25-day closings for certain purchase mortgages.

The full range of loans the company will fund includes agency and Federal Housing Administration loans, jumbo mortgages, and home loans that fall outside of the Qualified Mortgage safe harbor from ability to repay liability. It also offers piggyback financing and small-balance commercial loans.

Abreu co-founded the company with Pat McCauley, Newfi's executive vice president of production, and Chief Risk Officer Michelle Constantine. All three mortgage industry veterans previously worked for GMAC Mortgage and GreenPoint Mortgage.