After putting non-qualified mortgage lending on hold at the onset of the pandemic, NewRez has reactivated that platform.

Non-QM lending could see an uptick in 2021,

“As we look ahead to a healthy and growing non-Agency and non-QM market, we are excited to provide options to highly qualified and strong borrowers that sit outside the traditional Agency guidelines,” Baron Silverstein, president of NewRez, said in a press release.

NewRez wouldn’t comment on specifics around the timing of its relaunch but the tailwinds from the election indicate the possibilities for heightened non-QM activity. The Biden Administration made clear that increasing the homeownership rate — especially at the low end of the market — is a pillar of its plan for housing and lending.

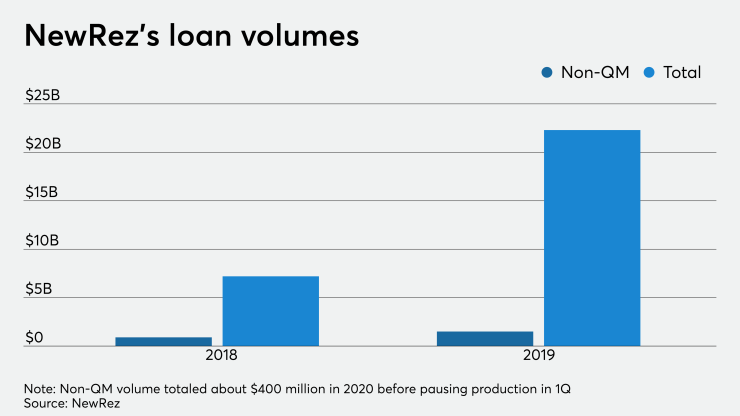

Non-QM volume accounted for about $900 million of NewRez’s $7.2 billion total in 2018 and $1.5 billion of 2019’s $22.3 billion. It produced nearly $400 million in non-QM volume in the first quarter of 2020 before pausing the product offering in March due to the coronavirus.

NewRez, the mortgage subsidiary of New Residential Investment, followed